I was recently interviewed by StarBiz about Iclif’s new programme offering called ‘Innovating Inside-Out’. The well-written piece by Zunaira Saieed was published in The Star on 4th April 2019.

A brief background on Innovating Inside-Out:

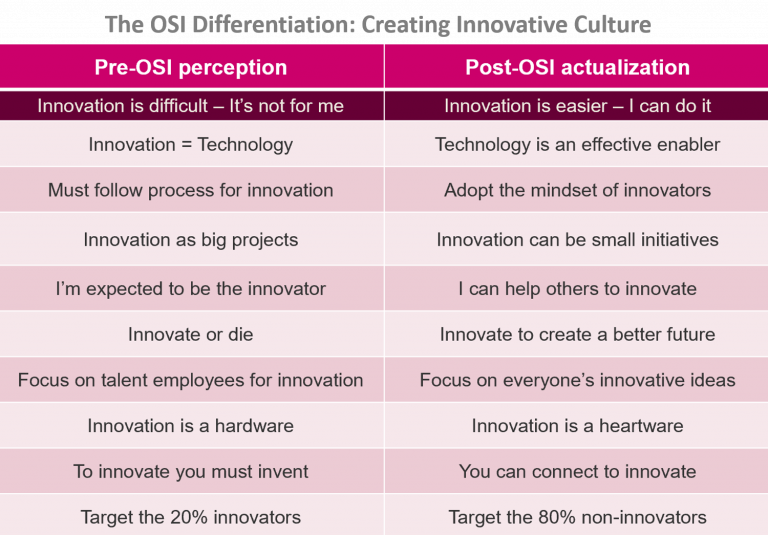

Along with appreciating how innovation has changed in the 21st Century, the Innovating Inside-Out program aims to challenge the top-down and outside-in organizational approaches to innovation. We ignite and grow the inner innovator DNA of employees from within. Participants will be liberated by the ease of innovating and will adopt the mindset of learning, shaping ideas, and experimentation.

It’s a session that will change how your people view the word innovator; and how the organization can start to tackle innovation from inside-out! At the end of the day, participants will:

- Appreciate how easy innovation really is in the Open Source era

- Spark their innovator DNA to create positive changes in the organization

- Learn key innovation techniques such as Empathy Lens© and Lateral Design©

- Develop skills to become a Think Buddy© and help others to innovate

Question 1: What are the benefits of going for this Innovating-Inside Out workshop for corporate companies?

The key benefits are 1) employees will realize that innovation is easier than they think; and that they too can be an innovator; 2) start to practice the skills of a Think Buddy so that you can help others perpetuate innovation; and 3) flip the stigma of the word innovation and unlock the innovative mindset for a better future. The more people joining this movement in an organization, the sooner we all move towards an innovative culture.

Question 2: How can we measure the success of the workshop for the companies?

The practice of Think Buddy begins and a behavioral shift towards people loving to talk about ideas and are not afraid to experiment.

Question 3: Have you noticed if the productivity of the company increases through the workshop you are setting up? What do the numbers really look like”?

I know first-hand that a number of participants from previous Innovating Inside-Out runs have put into place the Think Buddy practice as well as tried and tested innovative ideas in their respective organizations. I sat in a car with a participant whose mindset about innovation was completely flipped from negative to positive. Realistically, for the impact of a training program, I think the word I would use is ‘proactive’ towards innovation, which will ultimately lead to productivity.

Question 4: How have the responses been from the companies attending the workshops?

Let me quote the participants to answer this question; “This program has opened my mind about innovation. Anything can be considered as an innovation as long as it gives value regardless they are small or big changes. Innovation is driven by us and we must be open to accept ideas to begin with. Bravo. Till we meet again. Thank you.” – “Innovative! Unlike mainstream courses which often are too theoretical. Enjoyed it!” – “Fantastic experience with new understanding on innovation. Will definitely apply the concept of think buddy by looking at empathy and compassion as an idea booster. Thank you to Dr Thun and the team”.

The quantitative score on the Overall Value of this workshop was 98%.

Question 5: As innovation evolved in the 21st century, how can companies change their DNA? Please elaborate.

Companies must realize that, while innovation can and has come from a small group of masterminds, be it the R&D department, a merger, or even a Start-Up accelerator, the fact remains that to succeed sustainably in the 21st Century you must get your employees on board. And there is no better way to get people to befriend innovation than to make them see that innovation itself is friendly.

Innovating Inside-Out isn’t a training course per se, but an invitation to join a movement. We are living now in the world when innovation is no longer out of reach for ordinary people. Digital and technology do not replace humans. Rather they enable us to tackle things that were impossible to tackle before. You don’t have to be a genius or even a tech-savvy. All you need is an open mind and a pure heart.

For companies to change their DNA, the organization must empathize with their employees about the real challenges they face when tasked to innovate. Innovating Inside-Out supports people that they too can become innovators. It targets the 80% who are not yet innovators.

Question 6: Please tell us in detail about the Empathy Lens© technique, Lateral Design© and Think Buddy©? How can these techniques benefit companies?

The job of a Think Buddy is to help an idea grow. The other two are a couple of the key skills that a Think Buddy must be well-versed. Empathy helps you to see the world through someone else’s Lens – then you Design around the current limitations by exploring the possibilities Laterally. These two techniques sit behind all innovations we see in the 21st Century. And they too can lead to amazing ideas for organizations to explore.

Question 7: How important is it for corporates to innovate?

According to our study, 93% of corporate representatives say innovation is either Important or Very Important – with the majority voicing for the latter. What’s interesting is only 17% say that their people are innovative. Hence the need for a program like this.

Question 8: How many participants would you expect for a workshop?

Ideally, we’d like to stay below 30 for a workshop. But given that it is the beginning of a movement for Innovating Inside-Out, we welcome anyone interested to jump on board through executive sharing, breakfast talks, conferences, etc.

Question 9: Are these techniques to learn for all corporates or for companies in certain sectors only? And why?

There is no sector limitation. In the 21st Century, the ability to innovate will become a core skill – if it isn’t already is – like Microsoft PowerPoint that all employees know how to use.

Question 10: How important is it for traditional companies in Malaysia to innovate?

Especially important – and I’d say for any Asian/ASEAN countries for that matter. Most organizations in this region fall into two categories 1) national companies looking to grow beyond their borders or 2) labor-intensive operations that are no longer cost-competitive. Whichever it is, the way out is to innovate their way to a new iceberg – to borrow Dr John Kotter’s term.

Question 11: In Malaysia, how do you see our corporate sector innovating? How many percents is actually innovating?

I think I inadvertently answered this earlier in Question 7 – which is not much. But regardless of the percentage, we all can use more innovators. A recent survey in Asia-Pacific region by Ideaspies.com shows that 91% of employees believe they are the best source of innovation. So, I would assume the potential is there as well for us.

Question 12: Are we innovating fast compared to other South East Asian countries? Or are we lagging behind?

I would look at this as a collective challenge rather than at individual countries. Fact of the matter is, ASEAN will prosper together, or we will stagnate together. Besides, the core principle of Innovating Inside-Out is not about finding secrets that will allow you to edge ahead of others. It is about a collective movement of people innovating to make all our lives a little bit better. The hallmark of 21st Century innovation is more about doing good than being great – and you will see that throughout the program.

Question 13: What are the challenges you see in Malaysia for the corporate sector to be innovative?

The key challenge is to make being an innovator accessible to the employees. Currently, innovation is viewed as an exclusive skillset only for a small number of experts/top management. In the Open Source era, innovation is becoming more of a common capability rather than a job function. Companies that are successful in harnessing this inside-out approach will be even more successful when it comes to raising / implementing innovative ideas.

Question 14: Or the government needs to do? Your advice?

I think many corporates in Malaysia, like ones in other countries across Asia/ASEAN, are already putting a strong focus on innovation. The key is to keep a balance on innovating outside-in, top-down, and inside-out.

Question 15: How about what the government needs to do? Your advice?

If anything, government or GLCs are particularly suited for Innovating Inside-Out; since they have a large number of employees, hence a greater pool for ideas.

Question 16: Any targets for the Malaysian corporate market that you want to achieve?

Truthfully there is no specific market. Innovating Inside-Out is more of a movement than a training course. The goal is to invoke the innovator DNA that is within everyone – for people to realize that we now live in an era when the impossible become possible. Having said that, the immediate markets that will be impacted by automation/AI/data processing/robotics, of course, face the most eminent urgency to transform.

Dr Thun Thamrongnawasawat (Tan) is one of the foremost experts on dissecting complex management and business models and cascading them for easy implementation by companies across different industries. His innovative B.A.S.E. model has inspired numerous organizations to transform. He’s the author of the Brain-BASEd Leadership book series (2013-2016), a bestselling The Leadership Journey (2018) and a regular newspaper columnist. In 2015, Dr Thun was the recipient of World HRD Congress’s “Global Coaching Leadership Award” and named “Consultant of the Year” by the Ministry of Industry, Thailand.

He can be contacted at thun@asb.edu.my.

If you are interested to know more about our exciting Executive Education program click here.