Master in Central Banking

March 31

Application Deadline

12

Months Course Duration

Full Time Residential

Course Format

RM 335,000

Tuition Fees

Introducing the MCB Program

Overview

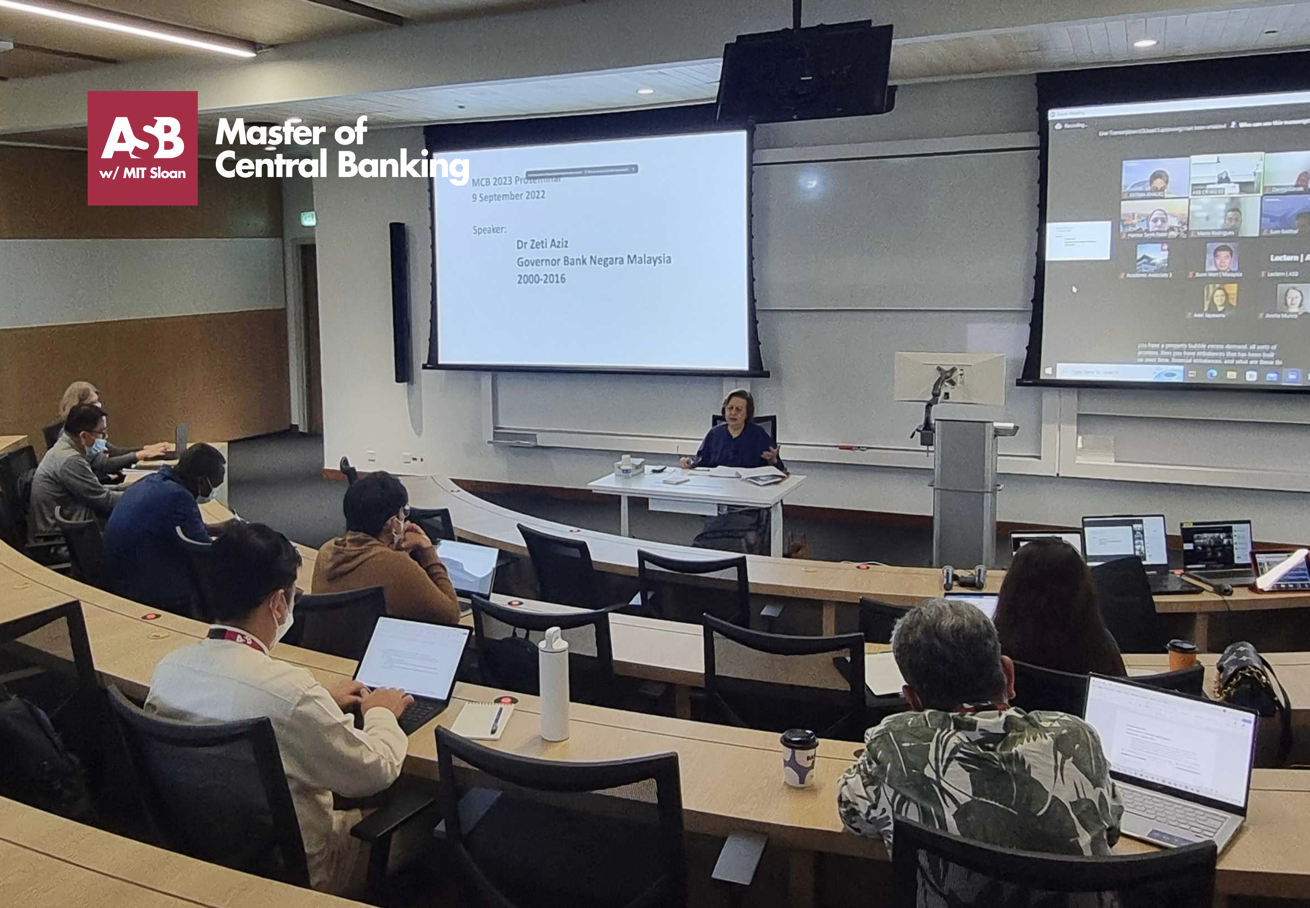

The Master in Central Banking (MCB) is a year-long residential program designed especially for central bankers. It includes a six-week MIT Sloan Immersion, during which MIT Sloan faculty will teach courses emphasizing systems thinking, best practices, innovation, and new technologies. This program is tailored for professionals employed in central banks and other public institutions responsible for carrying out related central banking functions.

Focuses Obssesively on Central Banking

Curriculum

The spirit of the MCB program is perfectly embodied in its curriculum, which focuses obsessively on central banking. It is integrative, connecting all the core functions of central banking. As at MIT, the approach to teaching is forward-looking, drawing on systems thinking and emphasizing best practices, innovation and new technologies. The MCB curriculum revolves around the following six pillars:

- Challenges Of Central Banks

- Crisis Prevention and Management

- Proseminar

- Accounting for Banks

- Innovation in Financial Institutions

- Financial Supervision

- Macroprudential Policy and Stress Testing

- Financial Regulation

- Financial Crime (E)

- Central Banking Master’s Thesis

- Research Method 1: Data Analysis and Visualisation

- Research Method 2: Applied Economic Analysis & Forecasting

- Research Method 3: Causal Inference for Policy (E)

- Payment Systems and Digital Currencies

- Strategy and Organizations

- Ethics

- Central Bank Governance & CB Communication

- Political Economy of Central Banks

- Negotiations

- Current topics in finance and policy

- Macroeconomics Foundations

- Applied Macroeconomics

- Monetary Policy Operations

- Monetary Policy I & II

- Current Topics in Macro and Monetary Policy

- Financial Market Development

- Financial Market and Asset Pricing

- Behavioral Finance and Inefficient Markets

- International Finance

- Islamic Finance for Regulators (E)

- Financial Economics for Public Policy (E

Academic Calendar

The MCB program features a core curriculum taught by MIT Sloan and ASB faculty, complemented by visits to financial institutions in the US. The curriculum includes a six-week immersion program at the MIT Sloan campus in Cambridge, Massachusetts.

What Sets Us Apart

MIT Sloan Immersion

MIT Affiliate Status

Pro-Seminars

Industry Exposure

Visit to the New York Federal Reserve

Visit to Black Rock Inc

Session with the Federal Reserve

Visit to IMF

Faculty

World - Class Faculty

The Master in Central Banking is taught by a mix of MIT Sloan faculty, world-class resident faculty at Asia School of Business, and former central bank governors and central bank experts from around the world.

Senior Director of Central Banking and Finance Programs, Professor of Economics

Ph.D. University of Chicago

Professor of Practice and Director of Central Banking Research Centre (CBRC)

Ph.D. The Philipp University of Marburg

Andrew Coleman

Visiting Professor

Ph.D. Princeton University

Ziyaad Mahomed

Professor at INCEIF & Chairman of the Shariah Board of HSBC Amanah Malaysia

Glenn Tasky

Former Director of Financial Stability, Supervision, and Payments,The SEACEN Centre

Patrick Honohan

Former Governor of Central Bank of Ireland

Alessandro Santoni

Head of Credit Risk and AQR FR1-Onsite Inspection European Central Bank

Shasha Kartini Ridzam

Director, Strategic Communications Department, Central Bank of Malaysia

Sloan Distinguished Professor of Finance,

Director of the MIT Golub Center for Finance and Policy

David A. Singer

Raphael Dorma-Helen Starbuck Professor of Political Science

Visiting Professor at the MIT Golub Center for Finance and Policy &

Former President & CEO of the Federal Reserve Bank of Boston

Faculty

Advisory Board

The Master in Central Banking benefits from the wisdom of an extraordinary Advisory Board, composed of a Nobel laureate and former central bank governors from around the world. The Advisory Board was deeply involved in the design of the program and development of the curriculum. Some of its members also teach in the program. Professors Merton and Orphanides are regular faculty members, while other Board members give guest lectures or teach short modules.

Robert C. Merton

School of Management Distinguished Professor of Finance, MIT,

Nobel Memorial Prize in Economic Sciences

Co-Chair, ASB Master of Central Banking Advisory Council

Former Governor, Bank Negara Malaysia (2000 – 2016),

Co-Chair, ASB Board of Governors,

Co-Chair, ASB Master of Central Banking Advisory Council.

Athanasios Orphanides

Former Governor of Central Bank of Cyprus

Jacob Frenkel

Former Governor of Bank of Israel

Jose de Gregorio

Former Governor of the Central Bank of Chile

Glenn Stevens

Former Governor of Reserve Bank of Australia

Patrick Honohan

Former Governor of Central Bank of Ireland

Stefan Ingves

Former Governor of the Riksbank

Martin Redrado

Former Governor of Central Bank of Argentina

Amando Tetangco

Former Governor of Bangko Sentral ng Pilipinas

Fee

Fee & Financing for MCB

RM335,000 ($USD76,000)

The fees above apply to the 12-month MCB program, starting in the 2025-26 academic year including:

Tuition Fees

Full regular fees for the 12-month MCB program which include the MIT Immersion Program & US Industry Trek

Accommodation

MIT Sloan Immersion Program

Airfare Tickets for the MIT Immersion Program in the USA (Return Economy)

Industry Trek

Visit to New York & Washington DC

Visa & Insurance

*For International Student Only

Action Learning

Lorem ipsum dolor sit amet, consectetur adipiscing elit. Suspendisse varius enim in eros.

Additional Information

Admission to the Master in Central Banking program requires sponsorship and endorsement from the candidate’s home central banking institution. We strongly encourage applicants who do not expect full financial support from their employer to actively seek scholarship opportunities independently.

Student housing costs are included in the program fees. As per Ministry of Higher Education Malaysia regulations, all students are required to live on-campus during their time at Asia School of Business. Students will have some choice in accommodation, with some options available for an extra fee and subject to availability.

Payment of program fees entitles both local (US insurance only) and international students to an insurance plan. This plan enables students to receive health care services during their stay at ASB, including during travel outside of Malaysia for the MIT Immersion Program.

Student Testimonials

Insights from MCB Program Students: Real Experiences, Real Success

I truly enjoy my work at the Central Bank. Being in the MCB program has further fostered a deeper appreciation and enthusiasm for the work that I do. It has provided me the opportunity to greatly expand my paradigm of knowledge. The exposure to new and diverse areas of learning provokes thought and helps me explore innovative solutions which will be most useful when I return to my role.

The MCB program provides a broad understanding of central bank management from the perspectives of both developed and developing countries, as well as current information around latest developments on digital economy and data analytics. The MCB program also provides broad networking opportunities with an international network of central banking friends to address the challenges posed by increasing global economic and financial integration.

The Master in Central Banking is an intense program but the people behind it – the excellent pool of professors and great MCB Program support team – make this learning journey truly worthwhile. The prime education and the unique learning experience I gain from being a part of this class will give me the edge to become a truly world-class central banker and a transformative leader.

I wish ASB’s Master in Central Banking program had been available years ago so I could have seized this opportunity sooner. For those keen on pursuing a career in Central Banking, I would recommend taking this course as soon as possible so that you can contribute more widely. In order to be a more holistic central banker, I needed to learn about other aspects of central banking. This program addressed that need. The Master in Central Banking program through its comprehensive curriculum that connects all the core functions of central banking provides you with a broad perspective and will assist you in deciding on a career path at the Central Bank.

Questions

FAQ

Here is a collection of frequently asked questions that can help you understand more about the program.

How long is the MCB program?

The MCB program is an intensive, year-long, full-time residential program. It is based in Kuala Lumpur (Malaysia), and it includes a six-week Immersion at MIT Sloan (Cambridge, MA, USA). Each intake starts in September and graduates in August of the following year.

How many students are there in each cohort?

The class size is capped at 40 students to encourage active in-class discussion and engagement with faculty.

What is the class profile?

The MCB is intended for high-potential central bank staff and seeks a diverse class representing advanced, emerging, and developing economies. This diversity of perspectives encourages the sharing of experiences and an appreciation of the importance of institutional contexts for central banking.

Is the MCB degree awarded by ASB or MIT?

The MCB degree is granted by ASB. Graduates receive a Certificate of Completion from MIT Sloan and are also granted MIT Affiliate status. Among other benefits, this includes MIT Email Forwarding for Life as well as access to MIT Affiliate events, networks and communications around the world.

How much is the program fee?

The program fee is RM 335,000 (approx. USD 76,000*)

Full regular fees for the 12-month MCB program starting in the 2025-2026 academic year include:

- Tuition Fees

- MIT Immersion

- Standard accommodation in Kuala Lumpur and during the MIT Immersion Program in the USA

- Program-related travel expenses

- Visas

- Insurance

- School supplies

The program fees do not include transportation costs for arrival at Kuala Lumpur to begin the program and return to home country at the end of the program as well as food, and personal expenses.

* The USD equivalent may fluctuate subject to prevailing exchange rate

Is financial aid available?

Admission to the Master in Central Banking program requires sponsorship and endorsement from the candidate’s home central banking institution. We strongly encourage applicants who do not expect full financial support from their employer to actively seek scholarship opportunities independently.

What subjects are covered in the curriculum?

The curriculum comprehensively covers the core functions of central banking including monetary policy, financial stability and payment systems, as well as management topics relevant for senior central bank leaders. The curriculum is forward-looking, offering courses in financial markets, data analytics and digital technology. The program also offers courses in international reserve management, developing financial markets and financial inclusion.

Who teaches MCB classes at ASB?

MCB classes in Kuala Lumpur are taught by world-class faculty, consisting of visiting MIT professors and ASB resident faculty, with guest lectures by numerous former and current global central banking leaders. During the six weeks on the MIT campus in Cambridge, MA, classes are with MIT faculty.

What is the teaching approach?

Courses are taught in a variety of different formats. Generally speaking, classes are taught through a combination of lectures, case studies, student presentations and group projects. The approach to teaching is integrative, drawing on systems thinking to integrate various streams of thought and data, and emphasizing innovative approaches to problem solving.

What type of accommodation is provided?

Participants stay at the ASB residential campus, adjacent to the academic campus. Available residential units include, one-, two- or three-bedroom apartments, all fully air-conditioned and furnished with linen, cookware and furniture.

The MCB program fees covers standard accommodation unit at ASB Residence – a one-bedroom apartments with shared kitchen, with larger units available for a nominal upgrade fee borne by the students.

The ASB Residential Center includes a dining area, fitness center, parking, and laundromat among other amenities.

During the 6-week MIT Sloan Immersion, participants are housed at the Marriott Residence Inn in Kendall Square, adjacent to the MIT Sloan campus.

What is it like to live in Kuala Lumpur?

Kuala Lumpur is a modern, multi-cultural city with a significant number of expats from all over the world, mixing in with people of Malay, Chinese, Indian, and other Asian heritages. It has all the amenities of the major cities of Asia, but with cleaner air and less dense congestion than many.

The ASB campus sits on the edge of the “Green Lung” of Kuala Lumpur. Directly to the west of the campus are vast green areas ideal for walks and bicycling. A rail stop for the KTM commuter line sits on the eastern edge of campus. This links ASB to all other areas of the city, including to the Kuala Lumpur International Airport.

Can I bring my spouse and/or children to ASB with me?

Families are welcome at ASB. The ASB Residential Center can accommodate families with larger apartments for a nominal upgrade fee borne by the students. Full-time university students typically get residential visas for spouses and children without any issues, although working visas for spouses typically require a job offer from a Malaysian institution. Kuala Lumpur has good schools, including international schools, that offer English language instruction, as well as schools where the primary language of instruction is Chinese or Bahasa Malaysia.

Where will I live during the six-week academic term at MIT in Cambridge, MA, USA?

MCB students will stay at the Marriott Residence Inn in Kendall Square, adjacent to the MIT campus.

For students who plan to bring a spouse and/or children, the added room cost must be covered by the student or his/her host institution.

To date, we have had a 100% success rate in getting student visas to the USA for all of our MCB students.

We have an almost 100% record in securing spousal visas for the USA program, but we cannot guarantee 100% assurance for spouses desiring to accompany students to MIT. However, spouses remaining in KL during the MIT program will be able to reside in ASB Residence.

What does the MCB look for in candidates?

The MCB program seeks candidates with substantial work experience in a central bank who are sponsored by their institution. Significant other work or academic qualifications are also taken into account.

The ideal candidate is an outstanding, mature individual who is capable of thriving in a dynamic, rigorous learning environment with academic and professional standards similar to those of MIT Sloan graduate programs.

Employees of other public institutions that carry out related functions, such as financial supervision/regulation and sovereign wealth management may also be considered for admission.

At a minimum, applicants must hold a Bachelor’s degree (or proven equivalent) with a minimum CGPA of 2.50 or equivalent as accepted by the ASB Senate; OR a minimum CGPA of 2.00 and not meeting a CGPA of 2.50 can be accepted, subject to rigorous internal assessment.

Candidates without a qualification in the related fields or working experience in the relevant fields must undergo appropriate prerequisite courses determined by ASB and meet the minimum CGPA based on (i) to (ii). A letter from the Central Bank on applicant’s working experience is required as a supporting document.

They must either be native English speakers, have received a university undergraduate degree taught in English, or provide proof of English language proficiency.

Will the MCB program consider applications from married couples?

Married couples may apply. However, each person must be endorsed by a central bank and must submit an individual online application.

What are the criteria by which the Admissions Committee evaluates applicants?

ASB is seeking candidates with intellectual capability and a high degree of emotional maturity. When reviewing applications and interviewing applicants, we look for candidates who can articulate their professional and academic success, their ability to lead and influence others, and their collaborative spirit. Ultimately, the Admissions Committee seeks to assemble a class of highly qualified and diverse individuals who will bring the most to the MCB program and who will benefit the most from the program.

How does the admissions process work?

The admissions process involves four steps. In the first step, either a sponsoring central banks sends MCB the names of candidates it is willing to endorse, or an individual candidate expresses interest in the program while providing contact information for a central bank official who would provide the endorsement.

The candidate applies for admission through the Applications Portal.

Based on an assessment of the application, the committee decides whether to invite the candidate to an interview, either in person or over a video call (e.g.,Zoom, Skype).

The committee follows a rolling admissions process. At least once a month during the admissions cycle, the committee meets to select candidates to be offered places in the program and other candidates to be placed on a waitlist. This process is repeated until all the places have been filled.

What is the application fee?

There is no application fee required.

How does ASB evaluate the English proficiency of an applicant?

In accordance with Ministry of Higher Education (MoHE) requirements in Malaysia, all applicants whose native language is not English, OR applicants who have not received a university undergraduate degree taught in English, must provide proof of their English language proficiency by submitting one of the following valid test scores (the minimum required score is in brackets):

- IELTS Academic Coventional/Online (Overall band 6.0)*; OR

- TOEFL (Internet-based 60, Essentials (Online) 8.5) *; OR

- Cambridge English Advanced/Proficiency (169)* ; OR

- Pearson Test of English (PTE) Academic (59)* ; OR

- Malaysian University English Test (MUET) (Band 4)

*We can only accept English language proficiency test scores taken within two years of the date of the intake you are applying for.

If your undergraduate degree was taught in English and your institution was not from the following countries; USA, United Kingdom, Australia or New Zealand, you will be required to provide supporting letter to confirm English language as the medium of instruction for the undergraduate degree.

Who reads the MCB applications and conducts the interviews?

Applications are reviewed by the Admissions team as well as select faculty and members of the MCB leadership team. Interviews are conducted by members of the MCB Admissions Committee.

How important is the interview within the final admissions decision?

An invitation to an interview means that the candidate has been shortlisted for further consideration. We look for emotional maturity and the applicant’s ability to communicate in a clear and professional manner. Furthermore, the interview is used as a platform to get to know you better, beyond what is found in your written application. The interviewer will provide his/her recommendations to the Admissions Committee.

How long does an interview last?

An interview typically lasts approximately 45 minutes.

Does an applicant have to travel to Kuala Lumpur for an interview?

Depending on the availability and location of the interviewer and applicant, we will conduct an in-person interview or Zoom interview.

What does it mean to be on the waitlist?

The waitlist process differs from year to year, and will depend upon the number of applications we receive. Generally, waitlisted applicants will be automatically considered in the following round and will receive an updated decision in that round.

Does the MCB program offer deferrals?

The MCB will consider deferral requests on a case-by-case basis.

Do I need to submit copies of my transcripts?

You will be required to scan and submit your official transcripts from all institutions from which you earned a degree, especially your undergraduate degree. During the application process, we will accept unofficial transcripts, but formal transcripts are required by Malaysia’s Ministry of Higher Education for matriculation and approval of your student visa.

If your transcript is not in English, you will be required to provide an official English translation of your transcript when applying. You may use a professional translator in your locality or an English translation done by your university.

If your educational institution does not use a 4.0 Grade Point Average (GPA) grading scale, you must ensure that your transcripts include a description of the grading scale. If your transcripts do not provide this information, you must submit supplemental official documentation describing the grading scale used. It will also be useful if you can provide supplemental official documentation that indicates the GPA (on a 4.0 scale) based on the grades or points awarded by your academic institution.

Applicants admitted to the program will be required to provide an official transcript signed and sealed from each school attended. All admitted students will receive further instructions after they receive their admission decision. Any discrepancy between the scanned transcripts and official transcripts may result in withdrawal of our offer of admission.

How relevant are previous academic grades?

All of your previous academic work is important to us, and we will consider it as one component of your past performance alongside everything else in the evaluation process.

If I have a Master’s and/or Ph.D. degree, would I need to submit transcripts and degree certificates of these?

Yes. We require scanned copies of your transcripts and degree certificates for all degrees as part of your application. If these documents are not in English, we require official English translations of these as well.