ASB Research Series

The ASB Research Seminar Series (RSS) is a monthly series hosted by ASB that invites academics and professors from various universities worldwide to give talks and share insights about their research and ongoing work. They engage in discussions on various research topics with ASB’s esteemed researchers and faculty members, receiving feedback and comments on their work.

ASB RSS are now in hybrid mode and are usually held at lunchtime.

If you would like to present at and/or attend the ASB RSS please contact the Research Office: research@asb.edu.my

Upcoming Talks

Date/Time

Speaker

Title & Abstract

By Dr Shardul Phadnis, Professor of Operations and Supply Chain Management at Asia School of Business

For many, the events of Feb 28, 2026, are emotional and political.

For senior leadership in the corporate world, they are infrastructural.

Feb 28 is not about geopolitics alone. It fundamentally alters the exposure companies face. Four questions matter.

- What changes immediately?

- What changes structurally?

- Why does governance need to adapt?

- What are the urgent leadership actions?

What Changes Immediately

The fighting in Iran and the Middle East is significant. What matters equally is what follows. About 20% of the global oil and liquified natural gas (LNG) traffic, representing about 7 8% of global energy supply, passes through the Strait of Hormuz, which lies to the south and west of Iran. That traffic has effectively stopped with Iran’s retaliatory missile strikes at the Emirati US allies across the Strait.

The immediate consequences are already visible. The stoppage of crude oil and LNG shipments is driving up energy prices, raising input costs for many companies. This will have secondary effects on demand from businesses and consumers.

Blockage and rerouting at Hormuz affect transit times and compress global shipping capacity. This disrupts operational and tactical plans, which, in asset-heavy industries like chemicals or industrial goods, can extend 12-24 months with production committed several months in advance. When a chokepoint destabilizes, disruptions propagate forward through those commitments. Shipping insurance rates are likely to rise amid higher uncertainty and risk of cargo/vessel loss, propagating cost hikes forward through the supply chain.

How this all plays out for each company depends on its own supply network design and business model. Exposure analysis cannot wait.

What Changes Structurally

The more consequential shift is structural.

Iran has been a consistent US rival throughout the 21st century. President George W. Bush named it as part of the Axis of Evil (with Iraq and North Korea). Iran has continued to engage against the US ally Israel through its support of Hezbollah and Hamas; it has supplied the Russians with drones against Ukraine. The targeted killing of a sitting head of state inside his capital represents a significant escalation in sovereign norms. Whether this triggers wider conflict or not, it alters assumptions about escalation boundaries.

Even if this does not escalate into a broader war, it alters the geopolitical calculus and the perceived boundaries of sovereign escalation. This could reshape the geopolitical dynamics. To avoid a similar fate befalling them, states could rush to form new formal alliances to find safety in numbers. Could China fill an anchor role?

This could also make the US’s own allies wonder if they are completely immune to unprecedented actions that, until now, may not have been written in the rule books. With the Trump administration eyeing Greenland for months now, could the European allies really feel at ease that the US won’t pursue actions that are not in their rule book? And what may they do to create a deterrence against such an action?

Feb 28 marks a turning point in the assumptions underpinning the current global order. It is not immediate fragmentation, but the hardening of geopolitical and economic boundaries.

Senior leadership must now reassess the viability of their business and supply chain infrastructure – and adapt it accordingly.

Why Governance Needs to Adapt

The era of pursuing microscopic accuracy gains through better forecasting models and fine-tuned safety stocks is over. Now is the time to prepare for structural shifts. Companies need to build the capability to (a) systematically and rigorously ask the right and relevant “what-if” questions and (b) create and implement solutions to address them.

Today, an AI model can predict the generic impacts of this event. But it won’t articulate impacts specific to your business or your ideal strategic choices easily (unless you have trained an AI model for your business). And certainly, AI will not get an organization to move in the right direction to enact those choices. To enact, the governance structure needs to change.

The changes are needed in both long-term strategic investments in the organizational and supply chain infrastructure and its short-term operational and tactical orchestration. Building structurally adaptable infrastructure requires governance mechanisms that explicitly value flexibility. Simple payback analyses or probabilistic risk assessments are not enough. The governance mechanisms need to be geared towards clear identification of robust initiatives from contingent ones, based on rigorous assessment of underlying uncertainty.

Short-term operational and tactical planning also needs such flexibility. This typically involves creating multiple pathways to deliver value (in terms of sourcing, inventory, distribution, and routing options) ahead of time. Traditional inventory planning methods, built on probabilistic demand distributions, are not designed to handle structural disruptions. Governance models need to enable preparedness based on robust/contingent analyses of strategic choices with strong qualitative evaluations of vulnerabilities and constraints. A governance mechanism that relies solely on probabilistic analysis is likely to be inadequate.

Urgent Leadership Actions

Urgent Leadership Actions The most important leadership action for a CEO or a COO is to start building an organization that is operationally agile and infrastructurally adaptable. This requires changing mindsets and governance mechanisms. Foresight practices such as scenario planning greatly help achieve both. If this capability does not exist within your organization, it must be developed.

A disciplined scenario planning initiative is one mechanism for building that capability. Using systematic interviews, analysis, and visualization to reveal the team members’ mental models to themselves has tremendous learning benefits for the participants themselves (Research on strategic cognition of executives).

Comparing the insights from firsthand experience against those from the current decision making models can be insightful. Does scenario use reveal new developments or present known ones in a new light? Does it change your executives’ judgment about important long-term decisions? Do they see the benefits of flexibility more clearly? (Research insights from quasi-field experiments)

Go through the scenario process to see what strategic choices it recommends. Then see how your governance mechanisms handle the recommendations. Do they enable flexible investments?

In Closing

My team has been working on a scenario planning project with a large multinational company’s global supply chain team for the past 18 months. With a budget of over $1b, this team handles the company’s logistics, customs and regulations, shipper management, etc., for global transport. This organization’s visionary leader wants to bring scenario planning to the operational and tactical planning levels. The scenarios we delivered were differentiated along geopolitical fragmentation as the key defining axis, with an explicit mention of the Strait of Hormuz.

Our scenario process helped us see the criticality of this chokepoint for the company’s operations last summer. Its operations team is now exploring operational resilience strategies by considering that set of scenarios. The question is not whether such a capability is necessary, but how long you can afford to delay building it.

Dr Shardul Phadnis is a Professor of Operations and Supply Chain Management at the Asia School of Business. The views expressed are his own and do not represent the official positions of Asia School of Business or any affiliated institutions.

Originally published by Malaysiakini.

Why Feb 28 Changes The Exposure CEOs and COOs Must Govern

YBhg. Dato’ Seri Wan Suraya Wan Mohd Radzi, Ketua Audit Negara, telah diwakili oleh Encik Azunan Daud, Timbalan Ketua Audit Negara (Syarikat Kerajaan) selaku Ketua Pegawai Digital ke “AI-Powered Leadership Conference” yang berlangsung pada 2 Disember 2025 di Kampus Asia School of Business (ASB), Kuala Lumpur.

Persidangan berimpak tinggi anjuran ASB–Iclif Executive Education Center ini menghimpunkan tokoh perintis kecerdasan buatan (AI) antarabangsa, pemimpin korporat serta penggerak perubahan serantau bagi membincangkan landskap kepimpinan masa hadapan dalam era digital yang semakin kompleks dan berteknologi.

Majlis perasmian Persidangan telah disempurnakan oleh YB Gobind Singh Deo, Menteri Digital Malaysia.

Turut hadir Dr. Alifah Aida binti Lope Abd Rahman, Pengarah Bahagian Audit ICT, Jabatan Audit Negara.

Originally published by National Audit Department.

AI-Powered Leadership Conference

International financial centres (IFCs) serve as beacons for countries on the global finance stage. An IFC is like the nucleus of a nation’s financial activities, helping to connect financial zones in the country to international trade.

Growing and emerging markets have become more attractive to large global financial institutions as they provide a perfect combination of good talent, connected infrastructure, and world-class living at relatively affordable costs.

As global cities seek to ride this momentum and bolster their reputations as IFCs to attract capital, strategic insights to stand out in an increasingly competitive space become pertinent.

Metrics like the Z/Yen’s Global Financial Centres Index provide industry-trusted rankings of IFCs. But they are built on vast amounts of data and black box models that are less immediately actionable for financial centres.

IFCs should instead draw on competitive strategy theory and seek to identify and occupy what a US academic once described as “a lonely place on the frontier”.

By identifying multiple aspects that a host city or country excels in, an IFC can identify its comparative advantage, especially when combined to form a more unique proposition, and then building upon them to establish a core strategic position.

This can help the IFC to differentiate itself from competitors. Investors can then make more informed decisions about where to focus their activities based on specific value propositions and which IFC best fits their own mandates.

Case study

Malaysia illustrates how an IFC can identify comparative advantages and then exploit them.

In February 2024, the Tun Razak Exchange (TRX) in Kuala Lumpur, the Malaysian capital, was designated as the Southeast Asian country’s IFC.

Malaysia’s advantage comes from balancing conventional and Islamic practices while staying relatively neutral geopolitically and maintaining strong ties to key global regions. This can be seen from its history.

During the 1998 Asian financial crisis, Malaysia charted its own path instead of accepting aid from the International Monetary Fund. The government imposed selective capital and currency controls on outflows and established dedicated institutions to restructure distressed banks and corporations.

The unconventional approach drew scepticism from international financial institutions, which later came to see it as a pragmatic and effective policy response. It has since been widely cited as an instructive example of how developing economies can preserve financial stability, regain monetary policy autonomy, and accelerate economic recovery during periods of severe external and financial stress.

More broadly, Malaysia’s decisive response during the crisis helped cement its reputation for institutional pragmatism and financial innovation within the conventional financial system.

Malaysia has also led the way in the development of modern sukuk or Islamic bonds. Shell Malaysia, a non-Islamic corporation, issued the world’s first corporate sukuk in 1990.

The country’s Islamic financial market is not only well-developed and innovative but is also capable of attracting conventional investors who are not strictly looking for shariah-compliant financial products.

Other IFCs are more prominent in conventional finance. And some Middle Eastern cities are making increasingly ambitious moves in sukuk markets. But Kuala Lumpur is uniquely positioned to promote itself as a financial hub at the nexus of Islamic and conventional finance and attract a broader investor base seeking enhanced credit, liquidity and product diversification.

Indeed, Malaysia’s conventional and sukuk bond market is widely regarded as one of the most developed and active in Asia, estimated at US$557 billion as of November 2025.

Academic theory suggests that diversification across financial instruments with differing risk/return, structural, legal, and investor-base characteristics can provide a hedge against market volatility and systemic shocks.

Consistent with this view, during the 2008 global financial crisis, Malaysian conventional bonds experienced the widespread flight to quality effect with widening yield and repo spreads. But sukuk demonstrated relative resilience, with both yield and repo spreads reversing in its favour, reflecting differences in investor composition, risk-sharing structures and market dynamics.[1]

Malaysia’s competitive advantage is further bolstered by its ties to the rest of the world. Geopolitically, the country has remained relatively neutral, maintaining strong ties to the US, Europe, China and the rest of the Asia Pacific region, as well as the Middle East. This means it can connect multiple disparate regions and attract international capital flows, tapping into the demand for diversification.

One strategy to achieve this is to expand sukuk issuance in major global currencies such as the US dollar and the Chinese renminbi. This would reduce transaction frictions for international investors in dollar-denominated markets while positioning Malaysia to capture growing demand from renminbi-based investors and capital pools.

Kuala Lumpur can also pursue unique financial innovations that other IFCs cannot potentially offer, such as sustainable finance.

Unlike most other major Islamic hubs, Malaysia has abundant nature-based capital, including extensive rainforests, peatlands, mangrove ecosystems, and rich biodiversity assets.

Islamic finance principles have a strong conceptual alignment with environmental, social and governance, and climate finance objectives, particularly through an emphasis on asset-backing, risk-sharing, stewardship, and socially responsible investment.

This means Kuala Lumpur is uniquely positioned to develop and scale Islamic nature-based financial instruments anchored in natural capital. These may include sukuk and other shariah-compliant structures linked to conservation finance, carbon markets, biodiversity preservation, and sustainable land use.

This strategic positioning will further reinforce Kuala Lumpur’s role as a leading hub of financial innovation at the intersection of Islamic finance and sustainable finance.

Hub-and-spoke model

A country may have several financial zones with their own specialisations, functions and priorities. A financial centre differs from a financial zone in that it underpins and enables the other zones in their activities and specialisations. So IFCs and their respective zones can be treated as financial hub-and-spoke systems.

A successful financial hub must possess deep and liquid markets, supported by a well-established ecosystem of financial institutions, regulatory authorities, and complementary professional services. International investors must be able to transact efficiently within a transparent and predictable regulatory environment, complemented by strong legal infrastructure and seamless connectivity through world-class transportation and logistics networks.

These factors will allow the hub to integrate effectively with global capital markets and attract sustained international participation.

Kuala Lumpur benefits from having deep capital markets and multiple regulatory bodies such as Bank Negara Malaysia and Securities Commission Malaysia. It is also well-connected globally through international flights.

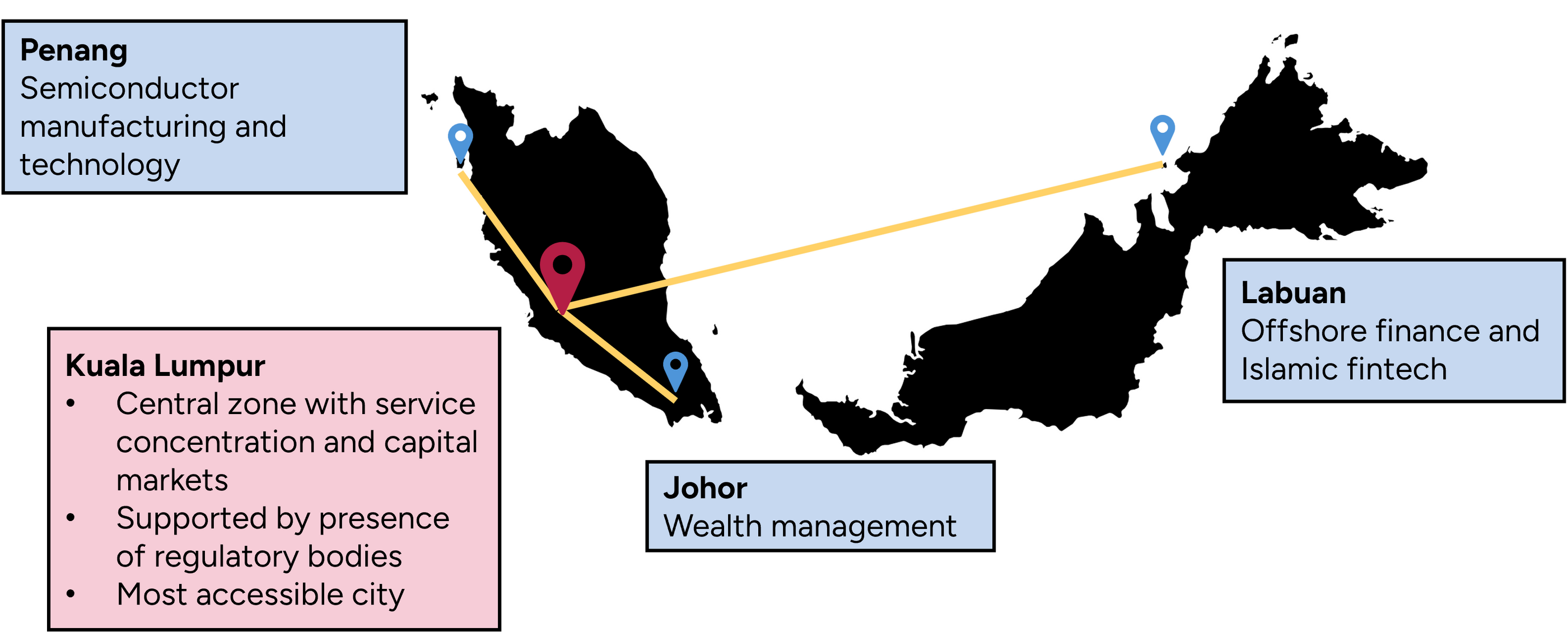

Kuala Lumpur serves as a strong hub that can be supported by other zones across the country ( Figure 1) that can act as the spokes.

Labuan, an offshore financial centre in East Malaysia that also specialises in Islamic financial technology, can lend its expertise in asset tokenisation to Kuala Lumpur while benefitting from trade through investors in the IFC.

The southern state of Johor provides wealth management and family office services, which can be further differentiated by leaning into the overall Islamic finance IFC strategy from Kuala Lumpur.

Meanwhile, the northern Penang state’s reputation in semiconductors, manufacturing and technology allows for firms in that zone and beyond that are expanding their operations to tap into Kuala Lumpur’s deeper financial market.

Figure 1. The hub-and-spoke model applied to Kuala Lumpur as a hub (red) and Labuan, Johor, and Penang and spokes (blue).

Talent strategies

An IFC’s competitive strategy should be supported by strong talent policies, including talent mobility. Relying on external talent may seem contradictory to a country’s national agenda, but it will increase the size of the talent pool so that employers can make hiring decisions that best suit their needs.

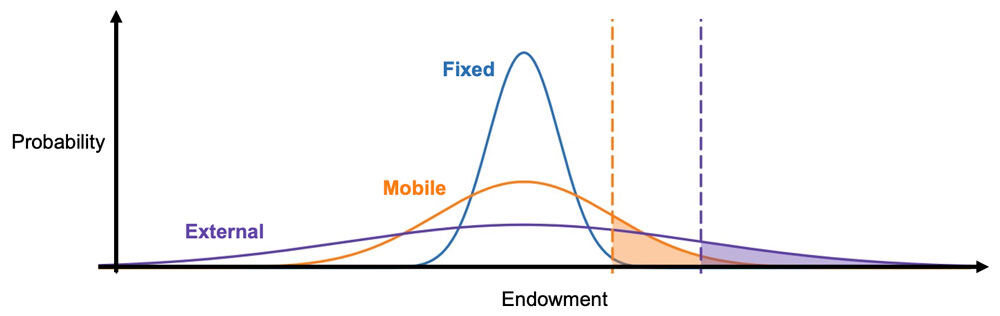

A simple financial economic model can be used to illustrate this point. We can extract talent mobility by considering the endowment distributions of fixed, mobile and external talent. Even if we assume that all three groups share the same mean endowment, each group has a different variance.

By virtue of increasing diversity and exposure, the fixed talent pool has the narrowest distribution, while the mobile and external talent pools have wider distributions, meaning that the latter pools have increased odds of finding better-performing outliers.

Employers in this model seek to make optimal hiring decisions and maximise productivity from endowment. Therefore, they hire mobile and external talent only if the talent has sufficiently high endowment such that their productivity outweighs the costs of relocating them for a new job.

Allowing employers to tap into talent pools with wider endowment distributions allows them to reach talent whose productivities outweigh their associated friction costs (Figure 2).

Figure 2. Illustrative distributions of the fixed (blue), mobile (orange), and external (purple) talent pools. Broken lines and shaded regions indicate mobile and external talent for which employers are willing to justify friction costs.

Different IFCs may adopt different strategies to facilitate talent mobility for both returning and international talent. For example, they can leverage their mandates to reduce costs for employers seeking the most appropriate talent for their needs, making it easier for employees to pursue work opportunities that are in a country’s national interest.

IFCs can also partner with the companies they host to accumulate data on hiring needs and make decisions and design policies accordingly.

The workforce at an IFC can also benefit from upskilling initiatives. As the financial and artificial intelligence sectors shift and evolve rapidly, continuous education becomes even more vital for professionals to react quickly and strategically to new trends.

To facilitate this process, an IFC can form strategic partnerships with leading academic institutions to connect companies to tailored education opportunities that can keep their talent competitive, upskilled and productive.

TRX partners Asia School of Business

In Malaysia’s case, the TRX emphasises service excellence as a core component of its talent attraction and mobility strategy. As part of this efforts, it has established a strategic partnership with the Asia School of Business to provide thought leadership, executive education, and microcredential programmes in both core and frontier areas of finance and management.

These programmes enable professionals to remain current with evolving developments in finance, leadership, supply chains and sustainability, while also strengthening capabilities in rapidly emerging technological domains such as AI and blockchain.

These initiatives enhance the broader IFC ecosystem by equipping professionals from high-value and high-growth industries with the advanced skills necessary to support innovation, competitiveness, and long-term economic growth.

Established international financial centres like London, New York, Hong Kong and Singapore have long been integral to the global financial landscape. But their comparative strengths lie primarily in conventional finance.

Emerging IFCs that are able to identify their comparative advantages and act on them will be able to effectively create and capture value, helping them to stand out globally while drawing more trade to their countries.

An IFC can extend its comparative advantage by publicising how it excels in a particular area of finance, such as through thought leadership efforts.

To be sure, not everything an IFC does needs to be completely unique. There will always be core services and transactions that investors expect from any IFC. But offering specialised, differentiated services can help investors decide whether to do business at a particular IFC.

* Lim Wei Han is an alumnus of Asia School of Business (ASB) and MIT’s School of Engineering. He is currently a research associate at Asia School of Business.

**This article draws on extensive research conducted for the TRX/Asia School of Business International Financial Centre Project and builds upon the analytical framework and findings developed in that context.

I would like to thank colleagues from Asia School of Business and MIT for their extremely helpful conversations, which shaped and strengthened this article. In particular, I am grateful to Professors Adrien Verdelhan, Asad Ata, Donald Lessard, Melati Nungsari, Pieter Stek, Renato Lima de Oliveira, Samuel Flanders, and Shardul Phadnis, whose insights helped to inform, clarify, and inspire key aspects of this research.

Originally published by Asia Asset Management.

International Financial Centres Should Seek Their Own “Lonely Place on the Frontier

Malaysia’s national AI agenda is moving from aspiration to execution. The National AI Roadmap and the forthcoming AI Technology Action Plan 2026-2030 signal intent to position Malaysia as a regional AI hub by 2030. The upside is significant; AI is expected to generate US$115 billion in productive capacity for Malaysia, supported by productivity gains across multiple sectors.

But policy ambition alone will not secure this value. Al impact will be captured by ecosystems that can translate strategy into capability, talent pipelines, leadership readiness, governance discipline and adoption at scale. International Financial Centres therefore become economic enablers, not just financial intermediaries. Their relevance is now defined as much by industry formation deployment as by capital flows.

Tun Razak Exchange (TRX) is emerging in this role. TRX’s collaboration with Asia School of Business to host the AI-Powered Leadership Conference brought together global academics, industry leaders and policymakers to examine leadership readiness, workforce shifts, ethics and what intelligent economies demand from executives. The core message was clear: AI competitiveness will be determined by leadership readiness, not only technical depth. As AI shifts from pilots into core business processes, leadership capability, strategic clarity and governance discipline will determine whether AI delivers sustainable returns or introduces systemic risk.

The talent constraint makes this urgent. The World Economic Forum’s Future of Jobs Report 2025 projects 170 million new roles will be created and 92 million displaced by 2030, resulting in a net gain of 78 million jobs, intensifying competition for digital and AI-ready talent. In parallel, 94% of leaders report AI-critical skills shortages today, with around one-third reporting gaps of 40-60% in AI-critical roles, and many still anticipating material gaps by 2028.

“As the financial, supply chains and AI landscapes rapidly shift and evolve, companies will need to ensure their existing employees, senior management and boards remain abreast of new trends and possess the skills, both core and frontier, to navigate these landscapes,” said Professor Joseph Cherian, CEO, President and Dean of Asia School of Business. Through its collaboration with leading global academic institutions like Asia School of Business, TRX connects companies with executive education, degreed and microcredential learning opportunities designed to meet the needs of modern professionals, keeping them competitive, upkilled and productive.

Against this backdrop, Monash University Malaysia’s new Kuala Lumpur campus at TRX reinforces TRX’s role as a talent and capability anchor within Malaysia’s International Financial Centre. While Monash expands AI and data science, education and research, TRX provides the surrounding ecosystem of enterprises and institutions where this talent can transition into enterprise deployment and economic impact.

But talent alone is not sufficient. As AI moves into core business operations, value will be determined by how effectively leaders deploy, govern and scale these capabilities. For C-suite leaders, AI leadership does not mean writing algorithms. It means understanding how AI works, where its limits sit, and how it reshapes decision-making, risk and accountability.

“TRX’s strategic value lies in institutionalising AI readiness by bringing regulators, academia, enterprises and talent institutions into one connected ecosystem,” said Dato’ Sr Azmar Talib. “Anchored by Monash’s RM2.8 billion TRX campus opening in 2032 and reinforced by ASB’s AI leadership platforms, TRX is building a robust AI talent pipeline for finance and technology. By anchoring executive learning, governance forums and leadership pipelines within an International Financial Centre environment, TRX is not just a financial address, it is where AI leadership capability, regulatory confidence and enterprise deployment converge.”

Originally published by The Edge.

Tun Razak Exchange: Building AI Leadership for Malaysia’s 2030 Intelligent Economy

Kuala Lumpur strengthened its global standing in 2025, driven by regulatory reforms, investor-friendly policies, and resilient macroeconomic fundamentals. Malaysia saw a resurgence in foreign direct investment, while the city climbed from 51st to 45th in the Global Financial Centres Index, signalling renewed investor confidence and competitiveness.

At the heart of this momentum is Tun Razak Exchange (TRX), Malaysia’s International Financial Centre. TRX leverages Malaysia’s #1 ranking under the “Prices” factor in the IMD World Competitiveness Ranking 2025, reflecting a structurally efficient and stable cost environment. This operating efficiency and predictability underpin Kuala Lumpur’s appeal as a long-term business and financial destination, enabling global firms to allocate capital with confidence. Purpose-built to anchor high-value economic activity, TRX offers IFC-grade infrastructure and a high service-level ecosystem, positioning Kuala Lumpur as a competitive player in the region.

Spanning 70 acres with a gross development value of RM40 billion, TRX hosts over 120 international and local firms, employing more than 20,000 professionals, a number set to grow as new developments come online. Guided by five core pillars-World-class City, Infrastructure, Talent, Catalytic Environment, and Hub of Convergence-the district integrates urban design, transport connectivity, talent pipelines, and policy facilitation, creating a robust foundation for Kuala Lumpur’s regional financial ambitions.

TRX’s landmark assets, including The Exchange 106, Menara Prudential, Menara IQ, Menara Affin, and the 10-acre City Park, collectively drive strong occupancy and tenant diversity. The district has reached 80% occupancy by net lettable area, with Exchange 106 housing 90% international firms, while the district overall has attracted over RM8 billion in private investment. Strategic developments such as Monash University Malaysia’s Global City Campus and PwC Malaysia’s headquarters further reinforce TRX’s role as a talent and knowledge hub, supporting both innovation and workforce development.

Connectivity and ecosystem collaboration underpin TRX’s success. As a key interchange for MRT Putrajaya and Kajang lines, the district serves 50,000 weekday passengers and links seamlessly to highways and pedestrian networks. Partnerships with Bank Negara, Labuan IBFC, Securities Commission, MIDA, and Asia School of Business enhance the city’s influence across ASEAN, while policy dialogues, academic institutions, and international delegations strengthen its global connectivity.

ESG principles are embedded at the core of TRX’s development, aligned with UN Sustainable Development Goals and international green finance standards. Achievements include LEED and GBI certifications, rooftop solar generating 190 MWh annually, low-carbon mobility, smart energy systems, and WELL Certification focusing on occupant health and well-being. TRX’s people-centric approach ensures sustainability extends beyond buildings to create a healthy, productive, and resilient urban environment.

Looking ahead, TRX is shaping a comprehensive financial ecosystem anchored on talent, business growth, innovation, and ESG. By 2035, the district is projected to attract RM12 billion in additional private investment, cementing Kuala Lumpur’s position as a leading financial and business hub in Asia while setting a benchmark for sustainable and forward-looking urban development.

Originally published by The Edge.

How TRX Shapes Kuala Lumpur’s International Financial Centre Position

Dear ASB faculty, staff, alumni, friends, partners and well-wishers,

As the year draws to a close and we look forward to a bright new beginning, I want to take a moment ‒ personally and sincerely ‒ to thank each and every one of you for the incredible journey we have shared together this year.

We are still a young business school, yet we have dared to dream big. Together, we continue to build a community that empowers bold, principled leaders to dream, disrupt, and drive a better future for Asia and the developing world. Our growing identity regionally and around the world as a global talent hub is strengthened by our collective commitment to translational research, regional connectivity, and our proud mantra: Global Inquiry, Local Heart

We have reimagined business education through our MBA, EMBA, and MCB (Master in Central Banking) programs, ensuring real-world impact through unique global immersion, strong industry partnerships, integrative and systems thinking, and our focus on growth mindset and lifelong adaptability.

And this year, we truly punched above our weight: our faculty shone on the global stage through keynote invitations at the top schools, global recognitions, and research excellence. We convened a groundbreaking AI-Powered Leadership Conference, underscoring our passion for shaping the future, which is further exemplified by our Agile Continuous Education (ACE) Microcredentials and our growing ICLIF Executive Education portfolio.

But none of this would have been possible without you. Your belief in our mission, your support, your cheerleading, and your unwavering faith in what ASB stands for have lifted us higher than ever before. For this, I am deeply grateful.

As we embrace this festive end-of-year season, I and my colleagues at ASB wish you and your loved ones a joyful, peaceful, and blessed holiday, and a truly Happy New Year. May 2026 bring us continued purpose, progress, and pride together.

With my warmest regards,

Joe

Season’s Greetings from ASB’s CEO & Dean

In this edition, we are excited to highlight “How to Make Scenario Planning Stick,” co-authored by our faculty Shardul S. Phadnis, Professor of Operations and Supply Chain Management, published in the MIT Sloan Management Review.

The article explains how scenario planning can equip organizations to navigate uncertainty by exploring multiple futures, adopting flexible strategies, and embedding foresight into everyday decision-making.

It also emphasizes that scenario planning is most effective when combined with practices such as dynamic monitoring, organizational agility, and strong leadership — helping companies anticipate change, respond quickly, and make resilient strategic decisions in an unpredictable business environment.

Read the full article here: https://sloanreview.mit.edu/article/scenario-planning-how-to-use/

Making Scenario Planning Stick

The Asia School of Business’ ACE Micro-credential courses bring together leaders from various sectors to rethink how they work and make decisions. These stackable micro-credentials help participants build a foundation towards the ASB Master of Business Administration degree, as well as pathways to advanced degrees at MIT and Yale. Here, we highlight some of the key outcomes from our courses:

- AI for Business Leaders: Instant Windshield Claims in Insurance (Professor Ong Shien Jin)

A group of insurance veterans joined our AI for Business Leaders micro-credential and immediately homed in on a major pain point: small-claims for windshield accidents. The existing process was slow and manual, involving adjuster reviews and workshop coordination, often taking weeks to complete.

During the hackathon for their final project, they realized the entire workflow could be automated using vision-based AI and large language models. Leveraging simple image-classification tools, they built a prototype capable of detecting damage severity and auto-approving straightforward cases, routing only isolated claims to adjusters.As a result, they estimated that with this AI-filtering process, approvals could be reduced from weeks to under five minutes.

Takeaway: With the right guidance and instructions, anyone can harness AI to transform their organizations, including redesigning legacy, deep-rooted processes.

- Digital Platforms & Marketplaces: International Shopper Platform (Professor Melati Nungsari)

Have you ever wondered how Temu, Alibaba, Shopee, or even Facebook works? One of our participants joined the Platforms & Marketplaces program to understand the science behind the giant tech platforms that are invaluable to us today. As part of his final project, he recognized a familiar Malaysian behavior: people requesting friends traveling abroad to kirim barang—the local term for bringing home goods unavailable locally.After discussions on supply liquidity and matching efficiency, he realized this was not merely a cultural quirk, but an untapped platform opportunity. That day, the concept of KirimBarang was created: a marketplace connecting buyers of exclusive foreign goods with travelers who have spare luggage capacity.

Using ideas and concepts from the course—escrow, ratings, route-based matching, and decentralized fulfillment—he mapped out a viable ecosystem where casual travelers become micro-entrepreneurs and global mobility becomes a service layer.

Takeaway: Platform and marketplace thinking reveals value not only in obvious assets, but in everyday behaviors and pain points waiting to be solved.

- Portfolio Management: Making Better Capital Allocation Decisions (Professor Joe Cherian)

A professional from a marketing background initially joined the Portfolio Management course to strengthen her investment skills and to be able to converse more effectively with finance-oriented stakeholders. What she learned reshaped how she approaches capital decisions and deepened her understanding of the science behind fund management.Professor Joe introduced a mindset shift: thinking like an institutional manager who balances risk and return. This framework clarified why portfolio management matters. By mapping her financial model in the same way Professor Joe mapped assets across risk, volatility, and strategic payoff, she realized that large organizations do not only manage projects, but entire portfolios.

The course’s emphasis on diversification, factor discipline, and mathematical correlations helped her build a stronger all-round portfolio, where uncorrelated investments help smooth each other out in times of uncertainty and risk through proven asset allocation strategies.

Takeaway: Portfolio thinking is not just for financial markets and bankers; it is a powerful tool for organizations allocating resources in uncertain conditions

ACE Microcredentials: Transforming Learning Across Industries

On 2 December 2025, the Asia School of Business hosted the inaugural AI-Powered Leadership Conference, an event organized by our ICLIF Executive Education Center and supported by our Strategic Partner, TRX City. We were proud to welcome leaders, innovators, and industry practitioners from across Malaysia and the region for a day of cutting-edge dialogue on the intersection of artificial intelligence, leadership, and the future of work.

The conference featured an exceptional lineup of global thought leaders, including Professor De Kai (a pioneer in AI translation technologies), Professor Sanjay Sarma (MIT Professor and Eminent Visiting Professor at the Asia School of Business renowned for his contributions to technology and innovation), Brian Wong (former Alibaba senior executive), and Professor Hiroshi Ishiguro (widely known as the “Father of Humanoids”). They were joined by the Asia School of Business faculty experts Professor Ong Shien Jin and Professor David Asirvatham. The event opened with remarks from YB Gobind Singh Deo, Malaysia’s Minister of Digital.

We extend our appreciation to our demo and exhibition partners, including DJI, Taylor’s University, LedgerBrains, ThakralOne, iFLYTEK, Biline, Beyond Insights, Symprio, Galactic Network, Vetece Holdings, and our supporting partner PIKOM, whose contributions enriched the experience for all participants. Their presence enabled attendees to engage directly with emerging technologies and real-world applications of AI.

Together, the conference highlighted a powerful message: while AI continues to transform industries at unprecedented speed, it is human leadership, ethical foresight, and purposeful innovation that will ultimately shape how we navigate the future of work.

AI-Powered Leadership Conference

P&G Center for Sustainable Small-owners Launches Two Insightful Publications on Research and Oil Palm Smallholder Sustainability and Inclusion

2 November 2025, Kuala Lumpur, Malaysia – The P&G Center for Sustainable Small-owners (CSS) at the Asia School of Business (ASB) has launched two new books under its Road to Certified Sustainable Palm Oil (CSPO) series, marking another milestone in evidence-based research and inclusive sustainability for Malaysia’s independent palm oil smallholders.

The books were unveiled during the Smallholder Dinner and Certificate Awards Ceremony, hosted by the Roundtable on Sustainable Palm Oil (RSPO) in conjunction with the RSPO Annual Roundtable 2025 (RT25).

The two titles — The Road to Certified Sustainable Palm Oil: A Guide to Understanding and Managing Peat Farms for Smallholders and The Road to Certified Sustainable Palm Oil: Learning from the Farms – Research for Impact — reflect CSS’s dual commitment to science-based knowledge and practical empowerment for smallholders through the P&G Smallholder Program.

Established in 2019 with support from Procter & Gamble (P&G) and hosted by ASB, CSS bridges research and practice to empower over 900 independent smallholders in Batu Pahat and Pontian, Johor, with sustainable, inclusive, and data-driven farming solutions, bringing them to achieve RSPO Smallholder certification and receive Premium for their oil palm produce. Rooted in field research and farmer collaboration, CSS represents an impactful effort to ensure that no farmer is left behind in the transition to certified sustainable palm oil.

“Sustainability in palm oil cannot be achieved by exclusion. It must include every farmer, different soil types, and every local reality,” said Professor Joe Cherian, CEO, President, Dean, and Distinguished Professor at ASB. “These books show how science, fieldwork, and partnership can transform challenges into pathways for inclusion, productivity, and environmental responsibility.”

P&G Chemical’s Sustainability Director, Francis Wiederkehr, echoed this commitment:

“In today’s global supply chains, including smallholder farmers is not just a philanthropic add-on — it is fundamental to our ESG strategy. When we support independent growers with knowledge, access, and systemic inclusion, we strengthen supply chain resilience, elevate livelihoods, and advance our ambition to source responsibly. Sustainable sourcing only becomes truly sustainable when every farmer, big or small, is a partner in the journey.”

Dr. Asad Ata, Director of CSS and Professor of Practice in Operations and Supply Chain Management at ASB, added:

“This publication shines a light on tropical peatlands, that are not to be further developed given their importance as carbon sinks and are often seen as difficult for cultivation. With Malaysia and Indonesia home to over 23 million hectares of peatland, 10% of which is cultivated with oil palm, it is important to reframe them as opportunities for responsible and inclusive sustainability to avoid exclusion of the smallholders and further deterioration of the soil. This guide provides a timely, science-based reference for smallholders with existing peatland plantations on how to balance productivity with preservation.”

Independent smallholders continue to face barriers such as limited access to knowledge, financing, and markets, as well as the complexities of managing peat soils and meeting certification requirements. The two books highlight practical, inclusive, and research-driven solutions to overcome these challenges and strengthen smallholder participation in sustainable supply chains.

Book 1: Understanding and Managing Peat Farms for Smallholders

This publication shines a light on tropical peatlands, often seen as difficult for cultivation, by reframing them as opportunities for responsible and inclusive sustainability. With Malaysia and Indonesia home to over 23 million hectares of peatland, 10% of which is cultivated with oil palm, the guide provides a timely, science-based reference on how to balance productivity with preservation.

Four Key Highlights:

- Bridging Science and Practice – Translates global research on peat and climate into locally relevant, farmer-friendly insights.

- Inclusivity in Sustainability – Promotes responsible management for legacy peat farms, ensuring no farmer is left behind, and they continue to benefit from the land, while preserving it for the future.

- Evidence-Based Interventions – Field data show farms applying good agricultural practices (GAP) achieved up to 35% yield improvement within three to four years.

- Shared Responsibility Framework – Connects peat management to Malaysia’s NDPE commitments and the UN SDGs, reinforcing smallholder roles in climate action.

Book 2: Learning from the Farms – Research for Impact

A compilation of applied studies, this volume showcases how real-world data from the program’s smallholder farms in Johor inform CSS’s program design, impact assessment, and policy engagement. It includes 11 studies across four themes; supply chain and traceability, RSPO smallholder certification, training and GAP awareness, and environment and agronomy.

Four Key Highlights:

- Field-Based Evidence – Data from learning and control farms guide targeted, measurable interventions.

- Digital Traceability Models – A Johor pilot demonstrates how digital tools modernize collection centers and enhance transparency.

- Practical Impact – Shows how awareness and capability building foster sustainable practices and stronger livelihoods.

- Scalable Solutions – Offers replicable models for policymakers, donors, and industry to expand responsible sourcing and inclusion.

Advancing Evidence-Based Sustainability through Collaboration

Both publications reinforce CSS’s role as a research and implementation hub at ASB. By combining academic rigor with practical fieldwork, CSS supports Malaysia’s broader sustainability and climate goals—advancing ethical sourcing, carbon stewardship, and smallholder prosperity.

CSS has collaborations with many industry stakeholders, including the plantation groups, district farmer associations and cooperations, such as Pertubuhan Peladang Kawasan, fertilizer chains and research and academic institutions such as UiTM, and Kellogg Northwestern, USA.

As the journey toward CSPO continues, CSS calls on academia, corporations, NGOs, and policymakers to collaborate in scaling inclusive, data-driven solutions that empower smallholders as equal partners in a sustainable future.

The CSS Road to CSPO series can accessed at https://csslibrary.publuu.com

Issued by: Asia School of Business

Contact:

Dr. Asad Ata

Centre for Sustainable Small-owners (CSS)

Asia School of Business

11, Jalan Dato Onn,

50480 Kuala Lumpur, MALAYSIA

Tel: +603 2023 3000

Email: hello.css@asb.edu.my

ABOUT THE P&G CENTER FOR SUSTAINABLE SMALL-OWNERS (CSS)

The P&G Center for Sustainable Small-owners (CSS) was launched in 2019, by funding from Procter & Gamble (P&G), to deliver on its Ambition 2030 goals through the P&G smallholders initiative. Housed at Asia School of Business (ASB), CSS is committed to empowering and improving smallholders’ livelihoods through traceability, compliance and capacity building through training and implementation of sustainable and best in class agricultural practices in accordance with global standards.

P&G serves consumers around the world with one of the strongest portfolios of trusted, quality, leadership brands. The P&G community includes operations in approximately 70 countries worldwide. Please visit https://www.pg.com for the latest news and information about P&G. For further information on P&G’s Responsible Palm Sourcing Program please contact: Dr Siân Morris (morris.s.1@pg.com).

ASB was established in 2015 in collaboration with MIT Sloan School of Management. ASB’s mission is to become a premier school of management in Asia and be recognized for its ability to develop transformative and principled leaders who will contribute to a better future and advance the emerging world. For more information, see https://asb.edu.my/research-office/center-sustainable-small-owners/.

Press Release For the Launch of CSS Books at RT25