Return on investment is everything when it comes to an MBA. Given the money you invest and the time you commit, MBA students will look for clear payoffs from their degree. When Varun Singhi decided to do an MBA at Asia School of Business (ASB) in Malaysia, the decision didn’t come lightly.

He had a solid job, and a wife and daughter to factor into the decision. Now, with a breadth of work experience, a book to his name, and new-found status as a blockchain expert, the benefits of his MBA are clear. Here’s five ways his MBA paid off:

1. Broad work experience

Varun came from an engineering background, with several years of experience working at IT companies in Silicon Valley and Bengaluru. It was, he describes, a “hardcore techy” experience—and he was keen for his skills to reflect more of an inclination towards digital leadership. “My goal was to position myself at the intersection of technology and business.”

Despite shopping around top US schools, he couldn’t ignore the Action Learning program at ASB, and what that would mean for his resume. “You travel to five different countries, experience five different cultures, and get an opportunity to understand the working culture of each country.” Varun’s action learning projects included working at energy company Petronas, and at Maxis Communications, both in Malaysia; a startup in Indonesia; and a government commercial bank in Vietnam.

It enabled him to put some of the theory he was learning into practice, while also helping him question some practices from his prior career. “Sometimes our thought processes are so rigid, we aren’t prepared to change,” he says. ”Action learning gives you an opportunity to think about how you change yourself in a dynamic environment.”

2. Education from a world-renowned business school

Varun’s initial interest for an MBA had been drawn towards higher-ranked, Ivy League schools. At ASB, he found he could get access to this same quality of education. ASB is partnered with MIT Sloan School of Management, with a large percentage of the course being taught by world-renowned MIT professors.

But more exciting for Varun was the opportunity to spend six weeks at the MIT campus in Boston. To make the most of it, he researched the program well, and reached out to professors early, to make sure no time was wasted. “I had to really nail down what I wanted to get from this program, because one and a half months can pass by really quickly,” he says.

3. A book on blockchain

During the MBA, Varun set his sights on a career in technology. But technology is a vast space, and he knew had to narrow down his options slightly. “I attended almost ten conferences, to keep a tab on what was happening in the market, what were the emerging technologies, and what was the market requirement.” Blockchain was a subject he’d always been interested in, and he quickly discovered it could be a niche where he could really apply himself and earn solid credentials.

He took a few online certifications, began contributing to white papers about blockchain, and soon found himself carving out a status as a blockchain expert. He built a solid network of mentors during his MBA, one of whom gradually persuaded him that he should apply his expertise to writing a book on blockchain consortiums (blockchain systems which are shared between different organizations).

He seized the opportunity, working for four months over the summer after he graduated, and in July 2020, ‘Blockchain Consortiums: A Comprehensive Handbook’ was published.

4. Digital expertise and a new job

Writing the book proved to be very fruitful for Varun’s jobhunt. He posted about the book on LinkedIn, which prompted one of his network contacts to approach him about a job. He is now the head of technology and operations at Blockchain Stealth Startup, building Malaysia’s first regulated and compliant digital asset exchange platform.

“I’m grateful that with the right mentor support, the right direction, and the right passion, I got to follow my aspirations.” Alongside this, Varun was accepted onto the prestigious Digital Economist apprenticeship program. The program brings together early stage professionals who want practical training in building digital-first businesses, with an emphasis on social entrepreneurship.

For Varun, it’s a great exercise in enhancing his digital leadership while displaying what he learned on his MBA. “This is an entrepreneurial digital training program, and being an entrepreneur means you have to be flexible enough to work with different cultures, rules, time zones. It’s a holistic picture of how you work in a group—here I’ve been able to leverage my action learning skills.”

5. Intangible benefits

While he has several clear tangible takeaways from his MBA, some of the biggest payoffs have been intangible. In the face of COVID-19, his MBA has given him the “ability to face uncertainty with certainty”, he says.

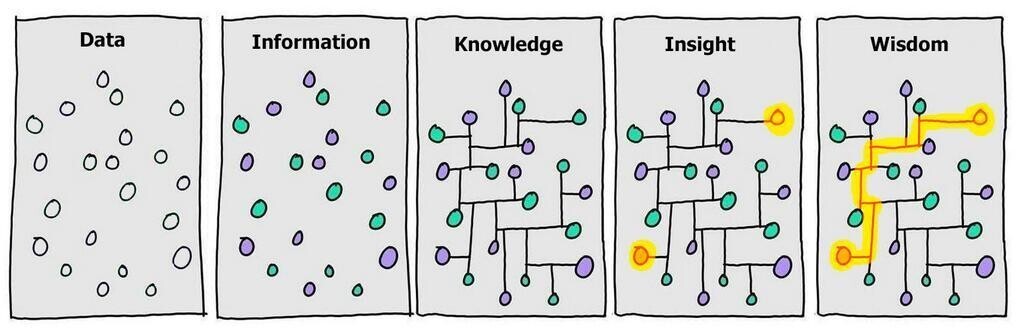

Secondly, inculcating himself with a growth mindset. “We talk about this in terms of companies, but I think the same for individuals. I’m able to step back and change my plans based on the situation. That is what the world currently wants—to see how dynamic and agile you are in terms of thinking.”

Thirdly, replacing his fear of failure with a fear of not trying things. This applies to everything from reorienting his career towards blockchain, to seizing the opportunity to write a book, to applying for the Digital Economist training program. More importantly, though, have been the benefits for his whole family. Throughout his MBA, and his career, Varun remains conscious of putting his family first.

“My MBA wasn’t just for me, it’s for my entire family. ‘The more we hustle, the more we experience, and the wiser we become’. That mantra—I communicated that to my family regarding what I was getting from ASB.”

Read the full article here.

This article was originally published on BusinessBecause, a network helping MBA students make connections before, during and after their MBA.