The issue at stake

It is not easy for most central banks to lend to small businesses, even when they wish to do so. Indeed, during the COVID-19 crisis, this is something they have been called upon to do. Central banks are geared up to lend to governments and to banks, but not to lend to small businesses. The reason they exclude small businesses is the need for good collateral, which most small businesses lack. What then can central banks do in this situation?

What many central banks have done is give commercial banks the incentives to do the lending. Bank Negara Malaysia, for example, provides regulatory relief, which allows small borrowers to postpone principal repayments, without the banks having to report the loans as non-performing assets. The Bangko Sentral ng Pilipinas allows banks to count loans to small businesses against the reserve requirement. These are good incentives to get banks to lend to small businesses. The policy issue at stake, however, is whether there is a way for central banks to provide the money directly for such lending. Can they do so in a simple way?

The hurdle

The hurdle many central banks face is that they operate under a rule promulgated by Walter Bagehot in 1873. In his classic work, Lombard Street, Bagehot said, “… a central bank should, in a crisis, lend freely, against good collateral.” That rule has been enshrined in the laws under which mamy modern central banks operate. The U.S. Federal Reserve, for example, is subject to the so-called “Section 13 (3)” of the Federal Reserve Act, which states that the Fed lend only against good security, even in “exceptional and exigent circumstances.”

The loan-pooling SPV

Nonetheless, in response to the COVID-19 crisis, the Fed has essentially been able to lend to a large number of small businesses. The mechanism it uses is called the Main Street Lending Program (MSLP). The legal device that allows the Fed to meet the good collateral requirement is a Special Purpose Vehicle (SPV) that pools the loans together. Indeed the use of this device at the Fed has become almost routine. It is used for the Fed’s other crisis-related programs, namely the Primary Market Corporate Credit Facility (PMCCF), the Secondary Market Corporate Credit Facility (SMCCF), and the Term Asset-Backed Securities Loan Facility (TALF).

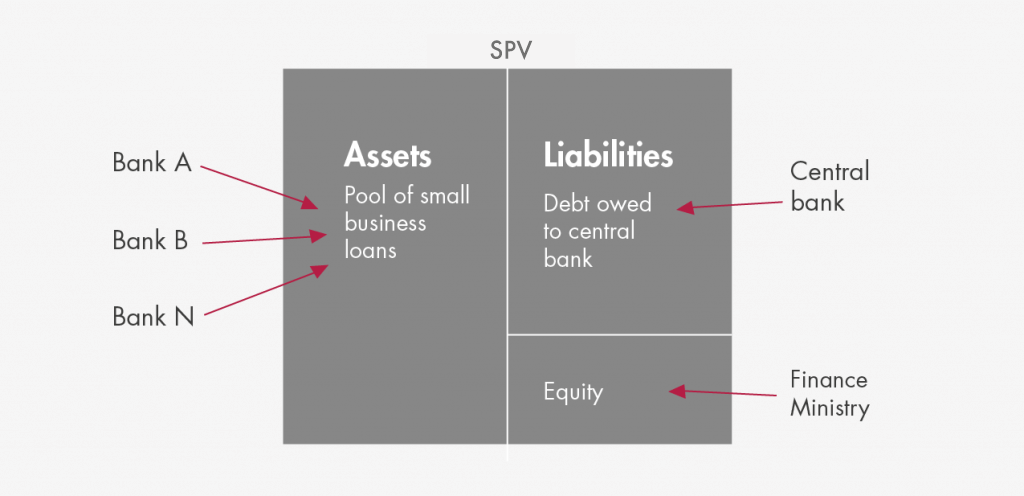

How does the SPV provide loans to small businesses? An SPV is a legal entity that is created for a specific financial purpose. The Fed creates such entities as its subsidiaries. In the MSLP, as shown in the diagram below, the Fed gathers from several banks a large pool of their small business loans, but choosing only those that satisfy certain criteria. This pool of loans is then placed in an SPV as its assets. With those assets serving as collateral, the Fed then lends to the SPV, which can then pay the banks for the loans in the pool.

Here the Fed does not lend directly to small businesses. It lends to them through the SPV. In practice, the banks know the loan eligibility criteria in advance and they make loans in anticipation of selling them to the SPV. The banks hold on to a residual of about 15% of each loan, so that they retain “skin in the game.” Pooling the loans in the SPV then allows the risks of such special crisis loans to be managed separately from the rest of the banks’ loan portfolios. As the small businesses repay their loans, the SPV repays the Fed.

Managing the risks

What makes the SPV’s assets count as good collateral? The short answer is risk management. Here the fiscal authorities also need to play a role. The ministry of finance would put just enough equity in the SPV to absorb likely credit losses. At the same time, the small business loans that go into the pool are chosen so that their risk characteristics are well understood. This means the risks of the pool as a whole can be carefully analyzed and managed. The analysis would tell the central bank how much equity it would need from the fiscal authorities.

The analysis would provide estimates of the average probability of default of the loans and the average loss given default. More importantly, the analysis would provide estimates of the correlations of defaults in times of stress. These estimates then lead to the calculation of the “value-at-risk,” which is the highest amount that could be lost from defaults for 99% of the time. In the case of the Fed’s MSLP, this amount is calculated to be 12.5% of the size of the SPV. Hence, for the pool of loans to be considered good collateral, the U.S. Treasury provides $75 billion in the form of equity in a $600 billion MSLP.

Keep it simple

While not all emerging market economies have the laws that permit SPVs, some do. Two jurisdictions that already have the legal framework for SPVs are Malaysia and the Philippines. In these countries, the central bank could already set up SPVs to provide loans to small businesses during a time of crisis. It is the SPV structure that allows the central bank to meet the “good collateral” requirement. Yes, the national government would need to agree to provide a small equity backstop. When the government is providing crisis funds anyway, the central bank’s SPVs would serve to leverage up those funds.

Should the central bank decide to set up an SPV for purposes of lending to small businesses, it should keep the structure as simple as possible, as it is for the Fed’s MSLP described above. At present, SPVs suffer from a poor reputation because of their role in the 2008-2009 global crisis. In that episode, subprime mortgages were bundled up in SPVs, the risks of which were misrepresented by lenders and underwriters. The more complex the structure, the easier it was to deceive investors. The belated recognition of the actual risks helped to precipitate the crisis. It is telling, however, that other loan-pooling SPVs with simpler structures, such as Collateralized Loan Obligations (CLOs), emerged from the crisis largely untainted. The lesson from all this is that the SPV technology itself is not the problem, but it pays to keep the structure as simple as possible.

If you are interested to know more about our exciting Master of Central Banking program click here.