Global supply chains, once celebrated for their efficiency, are undergoing a fundamental transformation. What began as targeted US tariffs on Chinese goods in 2018 has evolved into a structural shift in global manufacturing. Today, cost optimisation alone is no longer sufficient for competitive success. Firms that fail to build resilience, alongside efficiency, will increasingly find themselves structurally disadvantaged in an unpredictable trade environment.

Between 2018 and 2020, businesses scrambled to mitigate tariff-driven cost increases. The “China +1” strategy accelerated, with Vietnam emerging as a favoured alternative due to competitive labour costs, political neutrality, and beneficial trade agreements such as the Comprehensive and Progressive Agreement for Trans-Pacific Partnership and European Union-Vietnam free trade agreement (FTA).

US imports from Vietnam rose by approximately 35% during this period. Mexico benefited from nearshoring advantages under North American FTA frameworks, while Malaysia and Indonesia attracted new investments in electronics and rubber, although often tactically rather than strategically. Since 2024, trade tensions have expanded beyond the US-China axis. New tariffs now affect countries previously considered safe alternatives.

Malaysia faces substantial tariffs on semiconductor exports. Vietnam thrives in furniture manufacturing but faces challenges in high-tech sectors. Mexico remains relatively protected through the United States-Mexico-Canada Agreement framework. In this environment, reliance on any single manufacturing hub has become a strategic liability.

The Case for Restructuring Supply Chains

The vulnerabilities of traditional supply chain models have become increasingly visible. Industry analyses suggest that companies anchored to single-source strategies have faced input cost increases of up to 30% to 40% during major disruption periods, particularly in sectors such as electronics and automotive. Just-in-time systems, once lauded for their efficiency, now struggle with customs delays and shifting trade policies.

Geographic concentration, previously an advantage, now exposes firms to cascading disruptions. Organisations lacking multi-tier supplier visibility are particularly vulnerable. Success today demands a new mindset. Cost efficiency must be complemented by “real options thinking”, which involves building flexibility, scalability, and geographic dispersion into supply networks.

Investments must prioritise adaptability, alongside optimisation. Flexibility – or the ability to rapidly reconfigure sourcing, production, and logistics choices – will increasingly distinguish resilient firms from those anchored in rigid legacy models.

To help companies navigate this transition, the multi-hub resilience ladder offers a useful framework:

- Stage 1: single hub, cost-focused (high risk).

- Stage 2: China +1 (tactical diversification).

- Stage 3: regional multi-hub (operational resilience).

- Stage 4: global distributed network (strategic optionality).

Several strategies have proven effective in building resilience without sacrificing efficiency. Diversified multi-hub sourcing and strategically positioned buffer suppliers reduce localised risks. “Lean-plus” inventory models preserve efficiency while embedding buffers.

End-to-end digital visibility and predictive analytics enable better planning and faster disruption detection. Financial arrangements such as tariff clauses and risk-sharing agreements reinforce operational agility.

Regional Positioning and Strategic Opportunities

Leading companies show how this balance can be achieved. Apple’s relocation of selective assembly to India and Vietnam has evolved into full-scale ecosystem investments across India, Malaysia and Vietnam. Distributed manufacturing is now both contingency planning and a competitive strategy. Similarly, Ford and General Motors have reconfigured supply networks, building resilient corridors that allow production volumes to shift rapidly while maintaining efficiency.

Malaysia, once overlooked, now holds a strategic advantage with approximately 13% of global semiconductor back-end capacity. This is a vital position amid concerns over Taiwan’s stability. Malaysia’s trusted trade relationships and growing focus on sustainability strengthen its appeal.

However, full capitalisation will require strategic investments in specialised clusters, workforce development, and logistics infrastructure. Small and medium enterprises (SMEs) face disproportionate challenges. Without the reserves of multinationals, SMEs must leverage agility strategically.

Emerging practices in South-East Asia offer promising pathways. Malaysian SMEs in Penang form sourcing consortiums. Vietnamese manufacturers share logistics hubs. Indonesian textile SMEs use blockchain platforms to strengthen buyer trust.

In this environment, structured collaboration, rather than ad hoc partnerships, will define SME resilience. Like investment portfolios, supply chains become more vulnerable with concentration, while diversification mitigates systemic risk. Just as diversified portfolios withstand market shocks better, companies with distributed supply networks are more resilient against operational disruptions.

Emerging analyses suggest that centralised supply chains could suffer margin erosion of 15% to 20% by 2028. This parallels the historical underperformance seen in concentrated financial portfolios. What once made centralised supply chains a competitive advantage is now a strategic liability.

The deliberate creation of multiple viable pathways across the network is becoming critical. Firms must embed this optionality and build flexibility into their next planning cycles. As Prof Yossi Sheffi, a leading academic on supply chain resilience, aptly puts it: “Resilience is a hedge against uncertainty, not a bet on one outcome.” In a world where volatility is the norm, supply chain flexibility is no longer a differentiator. It will be the minimum requirement for relevance.

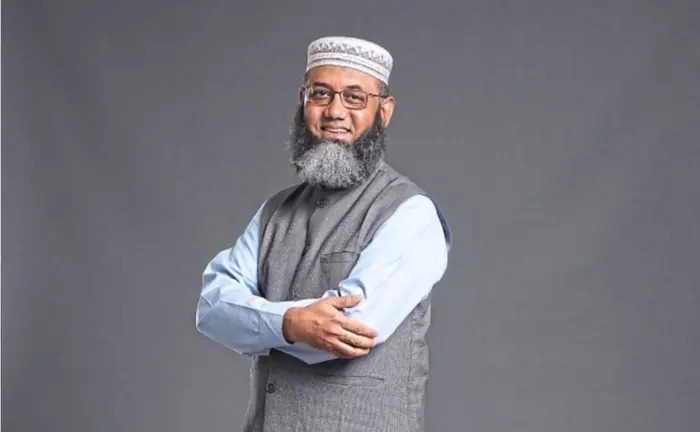

Dr Asad Ata is an associate professor of operations and supply chain management at Asia School of Business. The views expressed here are the writer’s own.

Originally published by The Star.