ASB students have many choices when it comes to how we spend the summer between our first and second years. Our Summer Associate Program is a lot like a regular MBA internship, but also includes an Action Learning project component and can take place anywhere in the world. And for those who don’t want to go the traditional route, ASB offers an “unconventional” option in the form of the summer Entrepreneurship Track.

This Track, designed for students interested in starting companies, gives us the freedom to explore and develop our own business concepts. Equipped with a research grant and assigned experienced entrepreneurs as our project advisors, we have the freedom to fully devote ourselves to a potential business without the inherent risks of actually starting a company.

As a part of this Entrepreneurship Track, I am completing an ASB-sponsored research project on the coliving industry in the United States and Southeast Asia. But what is coliving? If I asked ten different people this question, I would probably receive ten different answers. At its core, coliving isn’t a new idea. It describes a living concept that is specifically designed to increase human connection and create a sense of community.

Often, coliving units reduce the size of individual living spaces such as bedrooms and increase that of communal living areas such as living rooms and shared patios. This arrangement facilitates more face-to-face interactions between residents. Imagine that, instead of living in a large apartment building and not even knowing your neighbors, you lived in a building designed to create a close-knit community amongst all of its residents.

In the past six weeks, I have visited coliving locations in New York City, Los Angeles, San Diego, and San Francisco, and will be flying to Indonesia later this month to explore coliving companies in Bali. On June 7, I had the opportunity to attend Common’s Coliving Capital Markets Summit in New York City. The Summit was a fantastic way to begin my primary market research on the US coliving industry.

Here are a few of my main takeaways from the conference, as well as other lessons learned from my Entrepreneurship Track experience.

The Opportunity

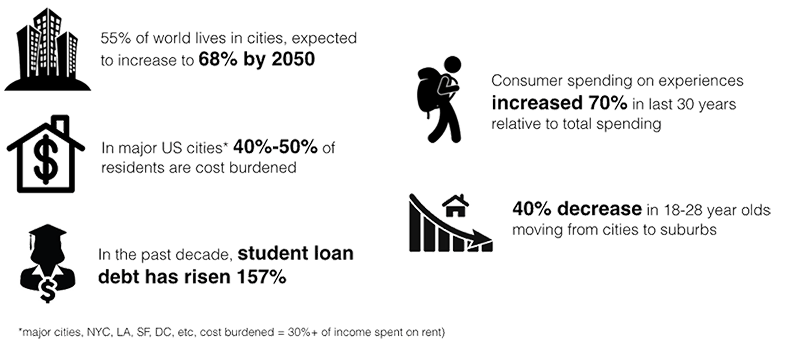

The opportunity for coliving in the United States arose due to the interplay of several major trends that you have already heard about: urbanization, rising student loan debt, valuing experiences over things, and rent spikes in major US housing markets such as New York City, San Francisco, and Los Angeles. Common’s Coliving Capital Markets Summit told a story of why these trends are now coming together in the perfect storm of a housing affordability crisis.

It also showed why all arrows are pointing toward coliving as the best solution. One of the panelists at the Summit, Susan Tjarksen from Cushman & Wakefield, recently published an extensive research report that sheds more light on the situation. Let’s take a look at some of the staggering numbers found in the report:

Source: Cushman & Wakefield’s Survey of the Coliving Landscape, May 2019

Individually, each of these statistics is not troubling. Taken together, they paint a scary picture. More people are living in cities and they’re living there for longer. Rents are rising, wages aren’t keeping pace, and student loan debt has financially burdened many potential homeowners. Due to this financial instability, millennials are not buying homes at the same rate as their parents and they seem fine with it. Most would rather go on an annual trip to Europe than own a bunch of furniture in a nice suburban home.

As seen in 2008, when the housing market stumbles, it doesn’t typically bode well for the American economy. Given this, what can we do to solve the housing affordability problem? How can we house more people in cities, at lower price points, and provide them with the experiences they’re looking for? The answer is coliving.

The Solution

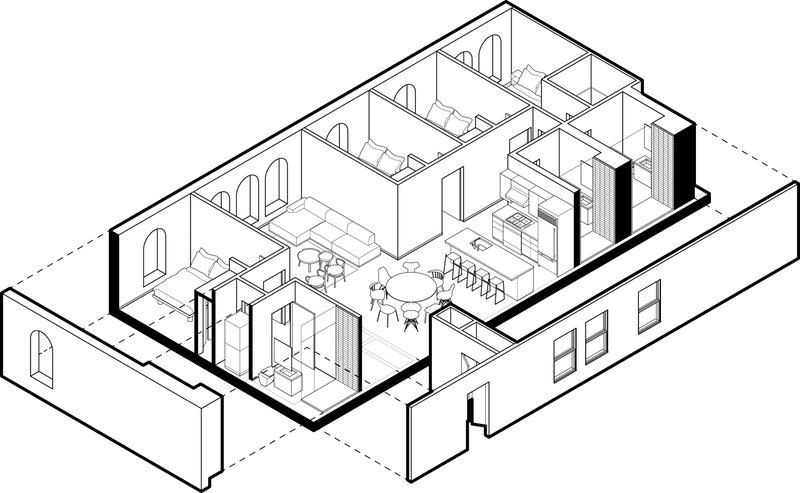

Coliving can provide urban populations with an affordable place to live AND the community lifestyle they are searching for. Coliving locations typically trade bedroom square footage for more shared living space, which allows them to house more residents than a typical apartment building of the same size.

Are residents willing to make this trade-off? During the conference, I learned that Common received over 20,000 applications last month to fill the roughly 1,000 rooms they currently have on the market. Residents are certainly willing to make the trade-off and it appears the supply of coliving units is nowhere close to keeping up with demand.

Example of a 4 Bedroom Common Coliving unit

When compared to traditional urban apartments, coliving stacks up favorably. Considering coliving’s slightly higher development and building costs, higher operating expenses (weekly events, fully furnished rooms), and additional gross revenue from rent (more beds, higher occupancy rates), Common estimates that coliving drives a 10%-30% increase in net operating income.

This increase in net operating income creates a favorable investment for lenders as well as a stronger value proposition for real estate developers. The coliving operator will benefit from the extra revenue generated and the tenants will pay a lower rent price and benefit from the community lifestyle. So who wins in coliving? Well, everybody involved.

The Future

Due to this “win-for-all” approach, many of the nearly 300 people at Common’s Summit are bullish on coliving and expect an explosion in the number of coliving developments in upcoming years. In fact, Cushman & Wakefield’s survey reports that global investments in coliving have skyrocketed from around $0.2 Billion in 2017 to $2.2 Billion in 2018.

For the remaining two months of the Summer Associate Program, I plan to visit many more coliving spaces in the US and Southeast Asia to understand industry best practices and outline the different coliving practices across the globe.

Without the Entrepreneurship Track opportunity at ASB, I would not have had the chance to attend the Summit or network with some of the biggest names in the industry. More MBA programs should develop similar summer tracks to give their students a risk-free way to explore business ideas and encourage more graduates to become entrepreneurs.