Tun Ismail Ali Center of Excellence

To lead, collaborate, and advance research excellence in monetary policy and economics, enhancing knowledge and innovation in emerging markets for Malaysia and beyond.

About Us

The Tun Ismail Ali Center of Excellence in Monetary & Financial Economics (TIACOE) is a Bank Negara Malaysia-endowed research center under the stewardship of the Asia School of Business. TIACOE serves as a research platform for its fellows and affiliates, providing a venue for central bankers, scholars, and graduate students to conduct research aligned with its mission. The center fosters knowledge exchange among academics and practitioners through conferences, seminars, workshops, and public lectures.

History

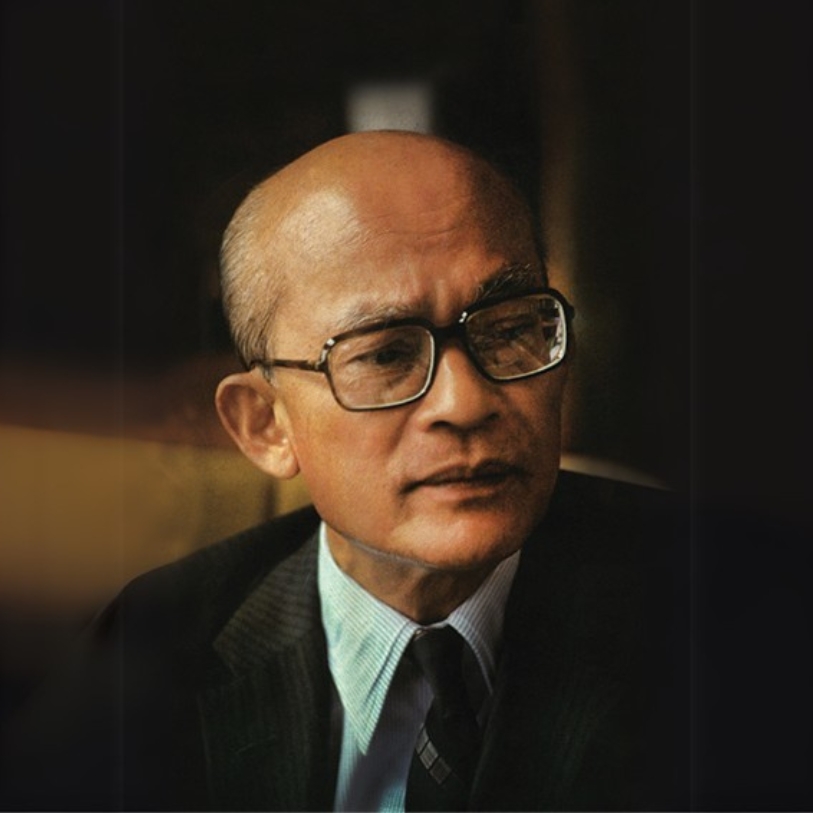

Tun Ismail Ali (September 16, 1918 – July 6, 1998) was the first Malaysian Governor of Bank Negara Malaysia (1962 – 1980). Born in Port Swettenham (now Port Klang), he was the nephew of Tun Abdul Razak, Malaysia’s second Prime Minister. He studied at English College, Johor Bahru, and later earned a scholarship to study at the prestigious Cambridge University, where he graduated with a degree in economics. As the first local governor of Bank Negara, he played a pivotal role in stabilizing the Malaysian economy, fostering financial discipline, and implementing policies to curb inflation and support industrialization. Following his retirement, Tun Ismail served in various advisory capacities and boards, contributing his expertise to Malaysia’s development. He became the first chairman of Permodalan Nasional Berhad (PNB), which was established to promote equity ownership among Malaysians, particularly the Bumiputera community. Renowned for his integrity and professionalism, Tun Ismail Ali’s legacy as a key figure in shaping Malaysia’s financial landscape is honored through various institutions and awards that bear his name.

Tun Ismail Ali

Governor of Bank Negara Malaysia

(1918 – 1998)

Our Mission

To advance research in the field of monetary and financial economics as well as elevating the capacity of local higher education institutions and widening outreach via engagements with local academics, students and the public.

To serve as a hub for research on central banking issues, with a focus on emerging markets and to carry out the related activities.

To host central bankers, scholars, graduate students and other persons as invited by the Founder or the Trustee who are interested to conduct research in any relevant field which is aligned to the objectives of TIACOE.

To serve as a hub for knowledge creation and knowledge exchange among academics by hosting conferences, seminars, workshops, and public lectures.

To provide training and advisory services to central banks and other relevant organisations to meet the objectives of TIACOE.

Past Events

Tun Ismail Ali Center of Excellence Faculty Directors

Dr Ho Sui-Jade is the Faculty Director of TIACOE, with extensive experience in monetary policy analysis and inflation forecasting. Before joining ASB, she served as Deputy Director in the Monetary Policy Department at Bank Negara Malaysia and co-led a subgroup for the Monetary Policy Workstream in the Network for Greening the Financial System (NGFS). A graduate of the University of Cambridge, Harvard University, and the University of Michigan, she has published in peer-reviewed journals such as The Review of Economics and Statistics. Her research focuses on monetary policy communication, inflation expectations, and macroeconomic dynamics, complemented by her role as an Associate Certified Coach with the International Coaching Federation.

Faculty Director of Tun Ismail Ali Center of Excellence

Dr Sang Seok Lee is a macroeconomist interested in monetary policy and central banking, international macroeconomics, and macroeconomic history. He is a research affiliate of the Centre for Economic Policy Research and a member of the Research Experts Panel at the Bangko Sentral ng Pilipinas Research Academy. Sang’s research has been published in academic journals such as the American Economic Review, the Journal of Finance, the Journal of International Economics, and the Journal of Monetary Economics. He obtained a DPhil in economics from the University of Oxford in 2014.

Professor of Economics,

Faculty Director of Tun Ismail Ali Center of Excellence

Research Team

Research Associate

Research Grant

Our grant supports research projects that advance knowledge and address key challenges in monetary and financial economics — with a focus on Malaysia and other emerging markets.

Through these opportunities, researchers can access funding to develop impactful solutions and contribute to meaningful progress. Our goal is to empower researchers with the resources they need to bring ideas to life and create lasting impact.

Note: Grants are not available at the moment. Please check back for future updates.

TIACOE Research Grant 2025

The TIACOE Research Grant 2025 recipients are:

- Dr. Awais Ur Rehman (Universiti Malaysia Sarawak), “Governance, Liquidity Creation, Efficiency and Stability in Islamic Banking: A Risk Adjusted Analysis of PLS and Non PLS Instruments for Liquidity Creation.”

This study investigates how Islamic financial institutions create liquidity through profit-and-loss sharing (PLS) and non-PLS instruments, and how this liquidity creation mediates the relationship between governance quality and banking outcomes such as financial stability and efficiency. The research aims to (i) develop a risk-adjusted liquidity creation index tailored to Islamic finance, (ii) differentiate the roles of each Islamic instrument and then differentiating for overall PLS and non-PLS instruments in liquidity generation, (iii) examine how liquidity creation channels the effects of governance on bank performance, and (iv) identify nonlinear threshold effects in liquidity creation that influence financial stability and efficiency.

- Dr. Ruzanna Ab Razak (Universiti Kebangsaan Malaysia), “Cross-Asset Contagion and Monetary Policy Transmission in Emerging Markets: Evidence from Malaysia and ASEAN Economies.”

This study addresses the critical question: How do monetary policy shocks propagate across a country’s financial system, and what role does cross-asset contagion play in the transmission mechanism? The primary objective is to quantify the interconnectedness among financial assets such as equities and Islamic financial indices and examine how monetary policy decisions affect these relationships. Specific objectives include: (1) measuring dynamic correlations and contagion patterns across asset classes during normal and crisis periods; (2) analyzing the differential transmission of monetary policy shocks through various financial channels.

- Dr. Timothy Kam (Australian National University), “Granular Loan Search Foundations of the Heterogenous Effects of Monetary Policy: Market Power and Banking-system Stability.”

We will provide two major contributions. First, we characterize the granular facts on business lending in Malaysia using the novel Malaysian Credit Registry data. We will advance evidence and measurements on the frictions in business lending, and how such lending activity may react over time to economic and policy changes. This study of liquidity frictions matters for understanding how monetary policy transmits through a heterogeneous business lending channel. Second, we will provide a model-based study of the interaction between granular search for business loans by heterogenous firms, its associated interaction with banks with bargaining/market power, and how there might be an important trade-off between regulating banking sector competition and banking system stability. The model and our data study will advance an evidence-based quantification of such a trade-off. Finding an optimal balance in this trade-off is crucial for contributing to policymakers’ understanding of monetary policy design in Malaysia.