Professor Joseph Cherian, a Malaccan, exemplifies a breed of influential academics with careers beyond the walls of academia, bringing global insights and experience to serve the communities he came from.

As Deputy CEO and Practice Professor at the Asia School of Business (ASB), Cherian’s career spans roles as an electrical engineer, a finance executive, and a philanthropic advisor. His extensive experience bridges the gap between theory and practice, enriching his teaching, writing, and policy contributions.

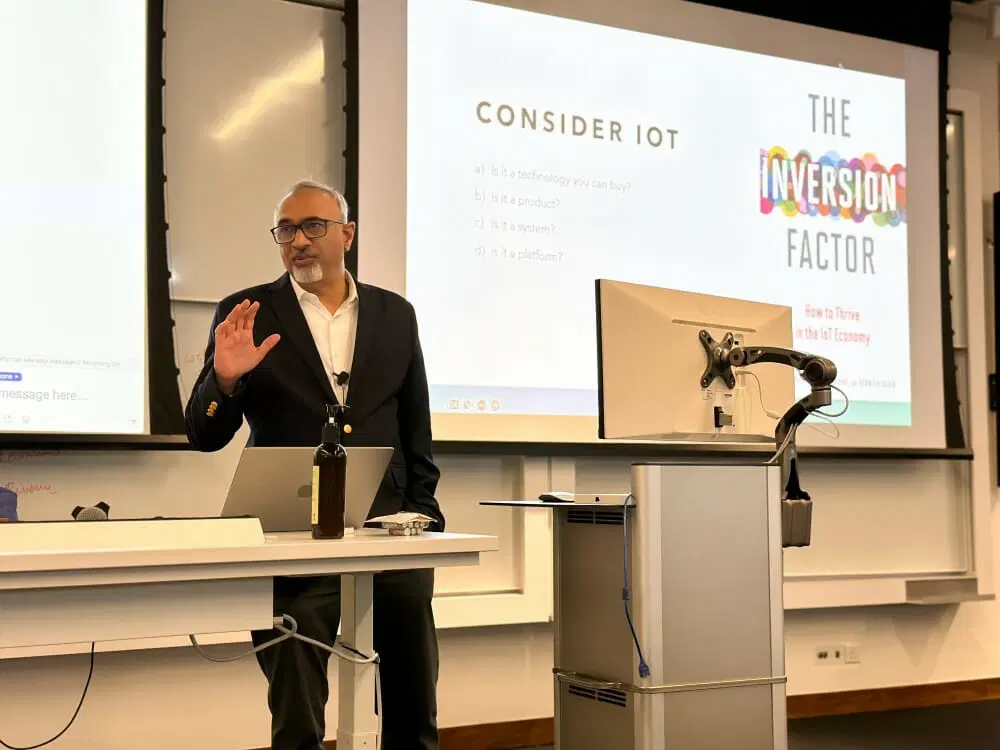

In the classroom, Professor Cherian weaves his real-world financial experience with theory, creating a dynamic learning environment that brings financial concepts to life for his students.

His approach reflects the “mind and hand” ethos of his alma mater, MIT, where he combines practical skills with theoretical knowledge to inspire flexible, hands-on learning.

I was able to blend my past experience as a US academic and more recent experience in the financial industry to make the classroom come alive with finance theory blended with real-life experiences, financial lab simulations, and tools like Bloomberg and Thomson Reuters workstations. It was truly experiential learning for the students. – Professor Joseph Cherian

From Engineer to Executive to Educator

Professor Cherian began his career as an electrical engineer but soon transitioned to finance. He earned a master’s and PhD in finance from Cornell University and eventually served as Managing Director and Global Head at Credit Suisse in New York.

While his career on Wall Street was impressive, his passion extended beyond professional success to making education accessible to others.

Ever conscious of his own humble beginnings as a former scholarship student at MIT and the grim financial realities of a world-class education, Professor Cherian has been committed to supporting students from low-income backgrounds in accessing world-class education.

I was a beneficiary of loans and scholarships from both MIT and the Kuok Foundation during my undergraduate years at one of the most expensive colleges in the US at that time (1982-86). The Kuok Family’s astounding generosity to aspiring Malaysian students, when such bursaries were fairly scarce, left an indelible mark in my mind. – Professor Joseph Cherian

In 2007, Professor Cherian and his wife Emma (Yanfang) began their philanthropic journey by establishing scholarships for MIT and Cornell University students. Their foundation has since provided vital support to many young students, including setting up the Yanfang and Joseph Cherian Bursary at the National University of Singapore, where they were both based for 12 years.

When I saw my first Wall Street bonus check, I was shocked and said “I am not worthy”. My wife was also in the financial industry, and we have no children. In the US we are known as DINKS (“Double Income No Kids”). So, what we did was to give back. – Professor Joseph Cherian

From Global Influence to Homegrown Impact

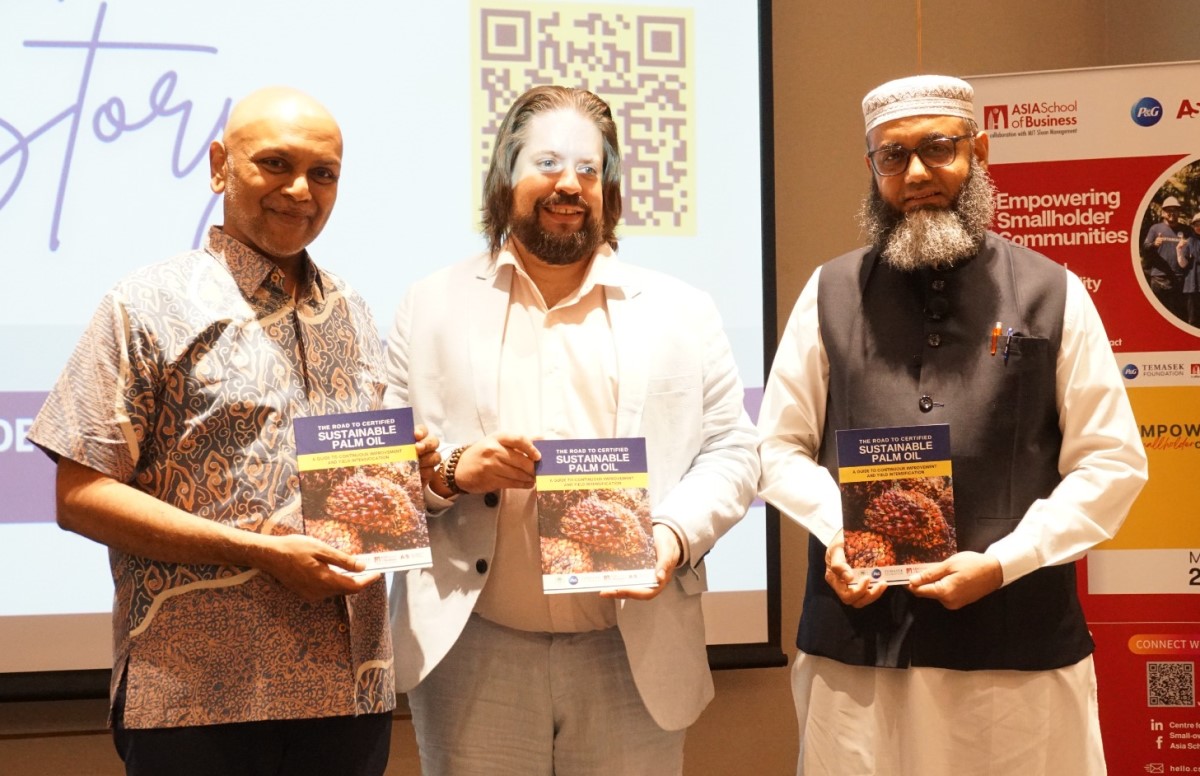

Currently, Professor Cherian serves as Deputy CEO and Practice Professor at the Asia School of Business (ASB) in collaboration with MIT Sloan and as a Visiting Professor at Cornell University’s Samuel Curtis Johnson Graduate School of Management.

He brings extensive experience from renowned institutions, having held positions at Boston University, the National University of Singapore (NUS) Business School, the University of Amsterdam, and Tinbergen Institute.

Beyond the classroom, Professor Cherian has contributed to high-level advisory roles, including working with Singapore’s Central Provident Fund and the Ministry of Manpower, Bursa Malaysia, and the Mercer-CFA Institute Global Pension Index.

With deep expertise in investment science, retirement reform, and sustainable investing, Professor Cherian also serves as an academic advisor to Asia Asset Management. In this role, he underscores the need for science-driven economic policies that prioritise climate action.

To move the needle on climate action, mainstream economies need to get in step with climate science. Countries – and the asset management industry – should therefore not lose sight of the substantial economic benefits from investments in decarbonisation. It also means walking the talk. As fiduciaries, asset managers should avoid greenwashing and excessive public relations stunts involving sustainable and net zero investing. – Professor Joseph Cherian[1]

Back to Homeland

Despite a successful international career and tempting offers from global institutions, Professor Cherian, who remains a Malaysian citizen despite leaving the country in 1982, chose to return to Malaysia in 2022, encouraged by his wife, Emma.

It was my wife, who is not even Malaysian, who convinced me to accept the ASB offer to move to KL. She said it was time for me to give back to my country. – Professor Joseph Cherian

While his academic achievements are numerous, his passion for advancing Malaysia’s financial education infrastructure shines brightest. He remains dedicated to nurturing future generations of Malaysians, equipping them with both knowledge and ethical integrity.

Revolutionising Education

He believes that flexibility in education is essential, especially in a world filled with uncertainty. Just as adaptability benefits us in career planning or financial investments, it holds equal importance in education, where the ability to respond to changing circumstances can add significant value.

To make learning more accessible and adaptable, Professor Cherian and his colleagues at the Asia School of Business (ASB) launched a platform called Agile Continuous Education (ACE). Designed to meet the evolving needs of today’s learners, ACE offers online courses that blend flexibility with hands-on learning.

Students can engage in self-paced video lessons, join live interactive sessions, and work towards professional certificates or even credits that count toward ASB’s MBA or Executive MBA programmes.

For example, a student taking Professor Cherian’s Corporate Finance course can watch pre-recorded lectures at their convenience, attend live online classes for discussions and simulations, and then continue with their day—whether at work or at the park.

ACE covers a broad range of topics, from Artificial Intelligence and Data Analytics to Sustainable Finance, allowing learners to tailor their education to their career goals.

We hope to ACE continuous education learners’ keen interest in both having flexibility and acquiring high-quality knowledge. This translates to substantial economic value. A classic case of having your cake and eating it, too. – Professor Joseph Cherian

Professor Cherian’s journey from Wall Street to the classroom in Malaysia reflects his dedication to bridging theory and practice for real-world impact. Through his work at the ASB, he is reshaping education to be more flexible and accessible, equipping future leaders to make meaningful change.

The Asia School of Business (ASB) has launched Agile Continuous Education (ACE), a dynamic series of hybrid courses to keep professionals at the cutting edge. Current offerings include Professional Certifications in AI for Business Leaders and Corporate Finance. Explore our sources:

- Cherian, J. and Thambiah, Y. Funding Net Zero. Asia Aset Management (June 2022, Vol. 27, No. 6). Link.

Originally published by Wiki Impact .